ISJ Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

From International Socialism (1st series), No.102, October 1977, p.17-19.

Transcribed & marked up by Einde O’Callaghan for ETOL.

The UK power generating industry is an excellent example of the way the capitalist crisis works. Despite record profits made by the CEGB (Central Electricity Generating Board), and by GEC and Reyrolle Parsons, the two UK power plant manufacturers, disaster looms. The Think-Tank report on the power plant manufacturing industry states: ‘Without appearing to overdramatise the situation, the position is that existing order books and the financial strength of some of the companies are not sufficient to enable the industry to survive in its present form. If the industry were required to undergo a major contraction in the next few years it would be unlikely to survive, either as an internationally competitive producer of power plant or even as a supplier of the full range of power plant required for the home market only.’ (ch.9 para 22)

There are two major aspects of the problem for the turbine-generator companies:

- The British companies are not internationally competitive;

- There is a world-wide over-capacity in the industry.

There are ten major world suppliers of generators. Two of these are UK based GEC and C.A. Parsons (a subsidiary of Reyrolle Parsons) – and between them they share about 8 per cent of the world market. With the exception of three Japanese firms, the only firms with a smaller output capacity are the ones based in Italy. The Japanese firms are exceptional. Their combined share of the world market grew from zero in 1960 to 10 per cent in 1973, and they are still growing.

The German based firm KWU was formed by a merger in 1969, and the giant French and Swiss firms Alsthom and Brown Boveri are currently moving towards a merger. Size is clearly crucial for survival. Plans for the future suggest a minimum necessary size of 10GW productive capacity to be competitively viable by the 1980s. The current combined size of GEC and C.A. Parsons is 10GW.

Not only are GEC and C.A. Parsons small, but the units they can build are smaller than all the other major firms. In 1977/78 they will be excluded from 83 per cent of the total forecast market solely because of inability to produce the large output units.

Also, the UK firms are incapable of taking orders on a ‘turnkey’ basis – where the firm takes over all responsibility for the provision and commissioning of the complete power station. 50 per cent of all export contracts and 95 per cent of all nuclear contracts in world markets have been negotiated on this basis.

Nuclear capacity is forecast to form 35-40 per cent of total capacity by the year 2000, and over 50 per cent of new installations from 1976 onwards will be nuclear. 35 per cent of these orders will be for the large 1300MW generators. The UK industry has no nuclear capability, and the largest generator so far produced by a UK company is only 660MW.

Larger through-puts, more standardisation, and long-term commitments by their domestic electricity supply industries have created more favourable conditions for competitors. Their heavy investment in capital equipment, modern production control systems and a higher level of automation have resulted in ‘a reduced dependence on direct labour skills’, and given them a competitive lead over the UK firms in the race for profits. The UK companies have fallen behind in investment, partly because their small size has meant they haven’t generated the necessary profits to pay for or justify the ever-more costly next stage of investment. They have thus been unable to implement many of the other economies of scale.

At the same time, the fall in demand for electricity during the recessions of the 1970s has led to a world-wide overcapacity in the power engineering industry. This has sharpened all the problems of competitiveness. Competition is so keen that Brown Boveri, the Swiss firm, has taken the trouble to distribute an edited version of the Think-Tank’ report to enhance its own appearance to potential customers.

Britain is by far the most electricity intensive country in the EEC, with a ratio of installed capacity to Gross National Product almost double that of France or Germany. Partly because of the recession, and partly because of overestimation of domestic demand for electricity, there is considerable surplus capacity for generating electricity in the UK. One of the cuts in public expenditure imposed by the Labour, government was the end of subsidies to the nationalised industries. The pressure on the nationalised industries to make a profit, after years of price fixing to subsidise private industry, meant an enormous rise in prices. The cost of domestic electricity rose 100 per cent in the two years 1974 to 1976, and the result was inevitably a fall in demand.

|

Employment by area in mid-1975 in the turbine generator industry |

|||||

|---|---|---|---|---|---|

|

|

|

GEC |

C.A. Parsons |

Total |

% of total |

|

Special development |

1,353 |

5,858 |

7,211 |

51 |

|

|

Intermediate |

2,820 |

– |

2,820 |

20 |

|

|

Unassisted |

4,223 |

– |

4,223 |

29 |

|

|

TOTAL |

8,396 |

5,858 |

14,254 |

100 |

|

By 1980, when the power stations now being built have come into use, suplus capacity will be about 35 per cent – excluding the usual 20 per cent margin for breakdowns, cold spells etc.

As a result, UK generating boards have not ordered a new power station since 1973, and have no need to place an order until at least the 1980s. The shop floor is still working on stations ordered before 1973, but this work is running down. Export orders too look increasingly unlikely.

|

These estimates are based on the unlikely assumption of a 3 per cent growth rate in Gross Domestic Product (GDP) and a high demand for exports. The post-war growth of GDP has only been 2.7 per cent, and this includes the ‘post-war boom’.

But the turbine generator industry is potentially highly profitable, and British capitalism is not prepared to lose it. One thing is clear: there is no room for two UK turbine generator manufacturers – nor for two boilermakers.

The dilemma is how to maintain the industry at a minimum capacity grossly in excess of that needed for the near future. Otherwise, if demand does pick up again, there will be no industry left. Merger and massive rationalisation, paid for at least in part from public funds is the obvious capitalist answer.

Nearly all these jobs are under threat over the next three years including the 7,000 jobs concentrated in the Special Development areas of Newcastle-upon-Tyne and Larne (Northern Ireland), which already have unemployment rates of 10½ and 13 per cent respectively. Tyneside is particularly dependant on heavy electrical and mechanical engineering, ship-building, ship-repairs and coal-mining. All these sectors are declining, and there have been heavy redundancies in the last five years, especially in the nationalised sector. The skilled unemployed vacancy ratio is 10 to 1.

Lame depends heavily on agriculture, ship-building and engineering and textiles. Further redundanices in all these sectors are imminent. If GEC were to close, unemployment in Larne would rise from 1,000 to over 3,000 out of a total of only 8,000 people with jobs.

|

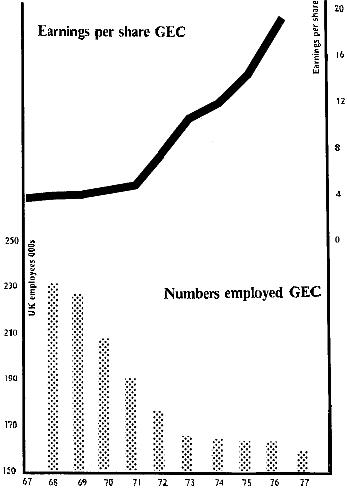

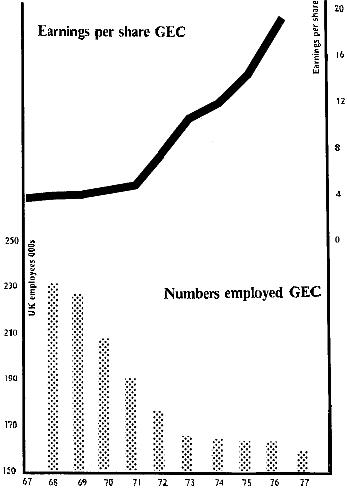

All the options for the power generating industry that have been floated: a GEC take-over of Parsons a joint company with GEC the majority shareholder, and Parsons and the NEB junior partners; a joint company with GEC holding 49 per cent and Parsons and the NEB holding the balance: will mean massive redundancies. Conservative figures, based on reasonably optimistic outlooks, reckon that over the next four to five years redundanices will he about 25 per cent of the industry’s workforce, or 7,500 jobs. The Department of Industry supports the need for these redundancies. (Financial Times 19.5.77). Arnold Weinstock, head of GEC, would almost certainly come out on top of the new company, whatever formula short of direct nationalisation is followed. Weinstock’s reputation as an axeman is well justified – since 1968 GEC has got rid of at least 64,.000 jobs, almost half through direct redundancy. If Weinstock does end up in control of Parsons, he will also have the major interest in the National Nuclear Corporation after British Nuclear Fuels Ltd the largest company in the British nuclear field. He has done an efficient propaganda job pitting Parsons workers against GEC workers, for example by declaring ‘No GEC workers w ill lose their jobs to save those at Parsons’. The record shows clearly that GEC workers will continue to lose their jobs, if Weinstock has his way. solely in the interest of profit ... We must demand the nationalisation of the industry without job loss, and that the government he responsible for every job. every wage packet. |

Another crucial factor is the impact on related employment – particularly the boilermakers. The collapse of the UK power generating industry would mean the loss of up to 18000 jobs from the two firms Babcock and Wilcox and Clarke Chapman concentrated in the employment black-spots of Gateshead and West Scotland.

One of the factors under discussion is the ordering of Drax B, the coal fired power station. The CEGB does not need the extra capacity which the station would provide, but Callaghan has now agreed to bring forward the order to appease the C.A. Parsons unions, and the NUM on the Selby coalfield. Even this move will only save some of the jobs under threat at C.A. Parsons and Babcock and Wilcox and on the Selby coalfield. And in seven years time, when Drax would come into operation, it would cost 2,000 power workers their jobs, as it replaced smaller, less capital intensive stations.

The CEGB has responded to the ordering of Drax B by cancelling its ‘steady ordering programme’ (a five year ordering programme from 1979 of two-thirds 660 MW plant). In the absence of rationalisation plans the CEGB sees no logic in maintaining a steady flow of work for two competing manufacturers’. This will mean the loss of GEC jobs in Trafford Park, Stafford, Rugby and Larne.

However the employment problem reaches further than direct employment in both cases. Drax B, for example, which is coal-fired, may save hundreds of jobs on the Selby coal-field, as well as jobs in the Sheffield steel and Yorkshire construction industries.

But even with state funds estimates of the redundancies required to ‘streamline’ the industry to something approaching competitiveness are at least 6000, with another 6000 going from the boiler-makers. (Financial Times 16.5.77)

|

The Central Electricity Generating Board made record profits of more than £100m in 1976/77. The figure for 1975/76 was £59m. The Board reduced its workforce by 5,000 over the last two years 1975 to 1977. According to the Board chairman Sir Arthur Hawkins, ‘this should be a lesson to the power engineering industry who need to shed many jobs.’ |

This is the dilemma. Under capitalism the competition for profits and survival leads to the development of larger and larger production units, employing fewer and fewer people. The growth in the productive capacity of each competing unit ensures that when demand for the product slows down, the industry is left with enormous over-capacity. A rapid process of contraction and retrenchment takes place, in which only the giants survive. In the contraction each competing employer attempts to increase its share of the potential profits by reducing employment and costs still further, in the desperate battle for existence.

ISJ Index | Main Newspaper Index

Encyclopedia of Trotskyism | Marxists’ Internet Archive

Last updated on 26.12.2007