From International Socialism (1st series), No.65, Mid-December 1973, pp.3-9.

Transcribed & marked up by Einde O’Callaghan for the Marxists’ Internet Archive.

THE EMERGENCY measures taken by the government just before Christmas are recognition of the fact that capitalism internationally is now entering its worst crisis since the war. For the British ruling class the prospect is particularly appalling. It is coming to the realisation that it cannot afford even the relatively meagre wage increases promised in Phase Three a mere six weeks ago. Yet substantial groups of workers who endured Phases One and Two in silence are clamouring to break through Phase Three.

The immediate cause for concern within the ruling class is the energy shortage, resulting from the combination of the oil cutback and the miners’ overtime ban.

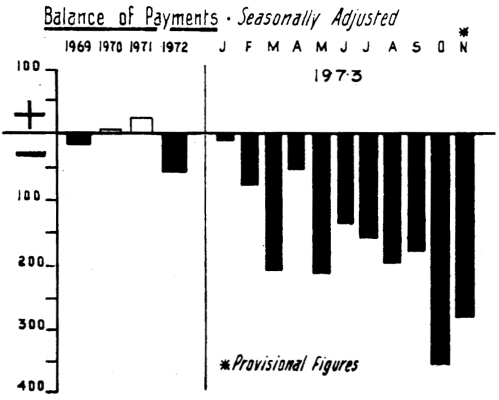

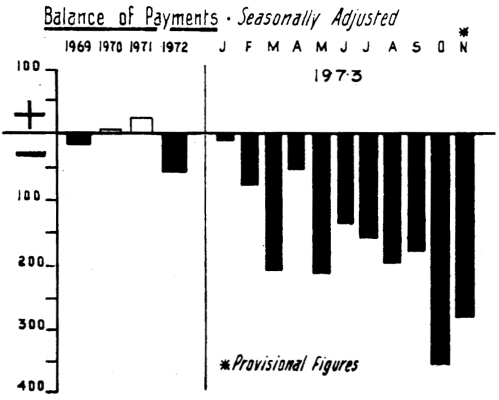

But in the medium term it faces an even more menacing threat: the first recessions since the war to hit all the major capitalist economies simultaneously. In the US optimistic commentators speak of a decline in the growth rate to one per cent and a rise in unemployment to six per cent; pessimists suggest a falling economic output by one or two per cent. In West Germany, Chancellor Brandt has warned of a zero growth rate next year, his economics minister, Friedrichs, talks of a decline in output. Japan, an economy structured on the assumption of rapid growth, is grinding to a halt for the first time in more than 20 years. France, Italy and Holland are facing the same threat of stagnation or even downturn. And in Britain the government is being forced to jam on the brakes by the pressure from price rises, a massive balance of payments burden and threats that the pound will drop even lower.

It is hardly surprising that there is panic in high places. In 18 months of boom with a virtually unprecedented upsurge in profits, the British government has not succeeded in raising the long term growth rate of the economy or the level of investment. Now it faces a period of stagnating markets and rising costs internationally, which it is much less able to confront than are most of its major competitors.

THE REACTION of big business spokesmen to the crisis has been to declare that the economy cannot afford the scale of wage rises suggested under Phase Three. As the Financial Times has put it.

‘The 3½ per cent growth rate on which Stage Three was originally based is quite irrelevant to our new circumstances.’

Edward Heath made the same point: if ‘as a result of the cutback in industry it is not possible to have that (3½ per cent) growth, then the logical conclusion is that there ought to be a cutback in the facilities of Stage Three.’ That any cutback at all on the Phase Three figures will mean reductions – and in many cases significant reductions – in living standard: for workers has been indirectly recognised by the president of the Confederation of British Industry. ‘Quite simply, what is going to happen is that for a time we all have less.’

The problem for the government, however, is that while the economic pressure is to backtrack on Phase Three, growing numbers of workers are pushing increases way above those intended under the policy. It is hoping with the imposition of three day working to show that it can stand up to the most powerful single group of workers, the miners.

It wants to isolate them, putting on their shoulders the blame for the hardship and short time working which is promised for most of industry in the period ahead. In effect, it is using the energy crisis as an excuse to impose a two day a week lock-out throughout industry until the miners give in.

And it hopes that through these measures it will be able to withstand the overtime ban for a long enough period for the miners to get demoralised and to vote for its Phase Three offer.

In this way, it believes it can avoid the unpalatable alternative of either giving in to the miners, or seeing the whole of industry grind to a halt. But that does not mean that its position is as strong as it thinks – particularly if the miners move from an overtime ban to an all-out strike and other workers fight for full pay for the locked out days.

Certainly, the most powerful sections of industry would not welcome any prolonged shut down at this particular point in time, even if it might ease the task of disciplining workers in the recession ahead. For, the international economic recession will not hit them for some months yet, and in the meantime they have full order books.

The car firms, for instance, who have been losing out all year to Japanese competition, must be hoping that with Japan (twice as dependent on oil as Britain for its energy supplies) being more severely hit than themselves by the oil cutback they will be able to recoup their losses. The only precondition is that they should be able to continue turning out cars as fast as possible for a few more months at least.

A drop in orders for cars may be on the horizon, but at present all the big manufacturers – British Leyland, Chrysler, Ford and Vauxhall – claim healthy order books and one senior executive summed up his competitors’ feelings when he commented: ‘We are going to produce just as hard and fast as we can.’ (Guardian, 12 December).

The government, however, is still relying on the trade union leadership to save it from an all-out confrontation. That is why all the editorials which have called for the government to take emergency action to hold back wages, have also spoken of TUC responsibility’. As the Financial Times has put it,

‘The Trade Union Congress, the Confederation of British Industry, individual trade unions and individual companies, all have a role to play.’

For the government, the key thing is to put increased pressure on the union leaders to comply. This pressure is taking two forms.

On the one hand there is the more or less open talk about a new package deal, under which the government would consider seriously amending the Industrial Relations Act in return for union co-operation in holding wages. The Tories may even be prepared to throw in with this a few food subsidies, so as to ease slightly the pressure on union leaders from their members. On the other hand, there is highly publicised talk about the dangers of ‘walking on the precipice’, with at least a million additional unemployed if we fall over.

Now, unemployment is certain to rise in the period ahead – although no-one knows by how much, if only because no-one knows how deeply the oil embargoes will bite or how long they will last. But the press and the government are deliberately exaggerating the immediate impact of the recession on jobs, because they believe that fear of a ‘national emergency’ will make it easier for them to get the union leaders to do a deal. They know that the mere whisper of crisis in the system makes the national union leaders fear for the position they have been able to carefully build up for their unions, their unions’ funds and themselves.

The threat of heavy unemployment is made more real by the imposition of immediate lay-offs, three day week working, and so on. It is this which gives punch to the propaganda. But in fact, what is actually being done is confusing two different sorts of unemployment: the temporary lay-offs which would be caused for a couple of weeks if the overtime ban in the pits led to sustained power cuts; and the unemployment due to a downturn in trade which is likely later in the year.

The first could cause the jobless total to rise, briefly, as it did in the 1947 fuel shortage, to as high as two million. The second would lead to more prolonged unemployment on a smaller scale. The Times, for instance, had predicted that with a 20 per cent cut in oil supplies and implementation of a deflationary policy by the government, ‘by the end of 1974 unemployment would be approaching 900,000’. This might be an underestimate – but it is a huge distance from the figures and the time scale being bandied around in the popular press.

THE OIL CUTBACK is clearly going to make the international recession more serious than it would have been otherwise. But it would be wrong to see oil as the cause of the recession. The signs of impending downturn in the major economies were apparent before the Middle East war, although they have become more pronounced since. Already in the summer a pattern was beginning to emerge reminiscent in some respects of the classic boom-slump cycle experienced by capitalism prior to 1940.

The essential features of the classic cycle were as follows. For a period production would expand at breakneck speed. Capitalists would invest in new machines and factories, new workers would be taken on to build them, other capitalists would have an incentive to invest in consumer goods industries to supply these workers, and so on. But at a certain point, the unchecked expansion of production would run into difficulties, due to exhaustion of the existing supplies of labour (or at least with the prerequisite skills) and stocks of raw materials. Prices and wages would zoom upwards, threatening to cut into profits. Capitalists would stop engaging on new investments at this point, not knowing in advance whether they would be profitable. Lay-offs would follow in the industries turning out means of production, leading in turn to a drop in the demand for consumer goods and to unemployment in consumer good industries. Eventually, whole industries would be virtually out of operation and a vast section of the labour force unemployed. After a period, the fall in the cost of labour, the cheapening of raw materials, and the ability of some capitalists to buy up the machines of their bankrupt fellows at cut prices, would lead to a renewal of economic activity and another boom, to be followed in turn by another slump.

The boom-slump pattern has been absent from the post-war history of capitalism. There have been cyclical variations in the rate of growth of different capitalist states, but never simultaneously in all states and never leading to large drops in output.

We have argued in this journal in the past that this change could only be fully understood by examining the stabilising role played by massive arms expenditure. In 1953, for instance, more than seven per cent of total production throughout the western economies went on arms. In the key US economy the figure was 10 per cent. Wealth which would otherwise have been available for ever more rapid rates of expansion during the boom, was side-tracked out of the system. And the unvarying market provided by the military for a whole section of industry tended to limit the development of recession. The western economies expanded at a slower rate than at the height of the classic boom-slump cycle, but evenly, without running out of labour and raw materials, so avoiding losses in production through slumps.

However, we also argued in the past that this arms economy had its own inbuilt contradictions, that were reducing its effectiveness. The arms burden was never evenly distributed. Some states hid under the nuclear umbrella provided by others. The cost of paying for the arms economy was borne by the US and, to a lesser extent, Britain; the benefits in terms of a continually expanding market were shared by Germany and Japan.

On this basis, Japan and Europe were able to plough back into productive expansion resources which in the US have gone into non-productive arms expenditure. Their economies have grown more quickly than the US, until today the sector of the US economy involved in economic competition (as opposed to producing arms, etc) is probably not much bigger than the comparable sector in the Japanese economy (which turns out very few arms).

One result has been a continual pressure on the heavy arms spenders to reduce the proportion of their national income going into arms, so as to be able to increase their effectiveness in economic competition. Overall, the proportion of world resources devoted to arms has declined, until it is now only about half the figure for the early 1950s. But with this decline has gone a decline in the effectiveness of arms spending as an economic stabiliser until, it seems, the old fluctuations are beginning to emerge.

At the same time, the growing integration of the different national economies during the long years of expansion (world trade has been growing at least twice as fast as world production) has reduced the ability of any one economy to protect itself from the downturns in the other.

Certainly, the boom of the last 18 months has been the most rapid in 20 years. It produced a frenzy of economic activity throughout the world, cutting unemployment everywhere, producing massive strains in terms of the supply of resources, pushing up prices and interest rates internationally. The oil shortage is as much a result of the boom as of the activities of the Arab sheiks (but for the boom, oil production world-wide would still exceed consumption). With other commodities, such as chemicals or paper, the role of a boom of unexpected vigour in producing the shortages is even clearer.

The shortages have led to an upsurge in commodity and raw material prices at the same time as the international rise in food prices (partly a by-product of increased world demand during the boom, partly a result of relatively accidental factors, such as harvest failures). This in turn has led to a flurry of speculative activity as people have attempted to make a quick profit, or at least to protect themselves against the effects of inflation, by buying up stocks of those commodities that are in short supply, so further pushing up their price.

Governments have found themselves helpless when faced with this situation.

They have hastened to take action to slow down the growth rates of individual economies, hoping to ease the pressure of prices before they eat into profits and destroy the prospects of further investment. (In the US, the upsurge in prices was putting profits under pressure even before the oil crisis – ‘estimates of corporate profits were for a drop of five per cent’, according to the Financial Times. Now the estimates speak of 10 or 15 per cent fall.)

But by cutting back consumption and investment country by country, government action has only served to further strengthen the trend towards recession internationally, confronting individual capitalists with the prospect of a slower growth of world trade, diminished potential markets and less incentive to invest.

It used to be claimed by Keynesians that government intervention could counter the cyclical tendencies in the system. The present crisis shows that the best they can hope to achieve with their actions (and it is not at all certain that they will even achieve that) is to make the transition from boom to recession slightly less painful than it might otherwise be.

SO ALL THE pressures are pushing the world towards recession. But that does not mean we are in for a repeat of the 1930s. The period ahead will differ from that in two vital respects. Firstly, the slump will be nothing like as deep or prolonged as in the thirties. It is worth remembering that a slump on that scale would mean massive falls in production, not just stagnation of output, and unemployment figures approaching five million in Britain and 20-25 million in the US. But today the economy is still cushioned against the worst form of slump by continuing arms spending. Even if the total figure is less than 20 years ago, it is still true the US spends 80 billion dollars a year on arms. In Britain, more is still spent by the government on ‘defence’ than by private industry on plant and machinery. Defence contracts remain a major source of markets for key industries: ‘70 per cent of the UK output of the aircraft industry is for the military, 35 per cent of the output of industrial electronics and 35 per cent of radio communications.’ Arms contracts account for 20-25 per cent of the markets of a major firm like GEC-AEI.

Consequently, even though the crisis will be the biggest most of us have known, it will still not be an old-time slump: rather than a massive fall in total output, it is likely to involve a spell of stagnating production throughout the world, during which unemployment will grow but not on the scale of the 1930s.

The crisis will differ from the classic slump in another way as well, which is less advantageous for the system. The slump provided capitalism with one positive gain. It destroyed inflationary pressures for a time by reducing the cost of materials and undermining the resistance of workers to wage cuts and speed up.

The recession will not achieve these ends. The monopolies which dominate major industries today tend to respond to enforced cutbacks in production not by reducing prices, but by raising them, so as to enable them to maintain as much of their profits as possible on a lower turnover. And certainly, under conditions of stagnation or small falls in output, rather than classic slump conditions, that is how they will respond.

Secondly, without really massive unemployment, it is doubtful if the resistance of any significant group of workers will be broken. In virtually every country, the pressure of the trade union movement has been growing over the summer, just as the turn from boom to recession has been beginning. It will last well into the recession itself, regardless of what governments, or trade union leaders for that matter, say. The experience during the last period of rising unemployment in Britain, two years ago, was that the impact of the recession on the wages struggle was minimal.

Other elements in the situation increase the chance of a still higher rate of inflation. The recession is likely to increase the role of governments in intervening to prop up key national industries (as the British did with Rolls Royce in 1970) and to provide investments which private industry cannot afford. The result will be that present inflationary levels of government spending will remain.

Finally, the increased international instability flowing from the Middle East war suggests that arms spending will climb. Even before the war, the US Congress gave approval to an arms programme based on the Trident nuclear submarine – ‘the most expensive weapon ever developed’. Since the war, the SALT talks between Russia and the US on arms limitation seem to have reached an impasse which will increase the pressure for more spending. The expenditure will not do much to ease the international recession. It is on technologically sophisticated and highly capital intensive projects which will provide little spin-off for civilian industry and will mop up very little unemployment. However, it will increase the pressure on prices – by heightening government expenditure and by absorbing scarce, highly skilled labour.

Under such conditions, even the purely speculative element in the present inflation is not going to be ended by the recession. It may well remain a better bet for those with wealth to keep it in the form of food-stocks or essential minerals rather than paper money of rapidly declining value.

FOR BRITISH capital the recession must spell the end of the hopes of the last year. The Tories let the balance of payments deficits pile up and the value of the pound tumble in the desperate belief that businessmen would start investing on a scale sufficient to restore the long term competitiveness of British capitalism and put it on the path of sustained growth. Only six weeks ago, when they launched Phase Three, they were still clinging to this belief and talking about a three and a half per cent growth rate next year. But investment only began to pick up, slowly, over the summer months and hardly was it underway before the international turndown and the oil crisis materialised. Faced with the deteriorating world situation, even the CBI is now prepared to sacrifice growth to ‘stability’.

|

For the Tory government, the situation could hardly be worse. Its programme for solving big business’s problems is in ruins. Its dream of sustained economic expansion has turned into a nightmare and inflation is worse than ever. Under such conditions, it will have great difficulty in maintaining its political cohesion. Within the ranks of the ruling class there will be those who complain bitterly that everything would have been all right if only Heath had deflated sooner. Bitter disputes can be expected between the leading sectors of industry who, seeing their future in Europe, have been prepared to let the oil companies export oil so as to support a ‘European oil policy’, and those – perhaps representing the majority of industrialists – who are bitter at the cost of this in terms of increased shortages at home. Similar disputes are likely between those who see clobbering the unions as the major goal and those who put first breaking into foreign markets while there is still time.

The only compensation for Heath is that no-one in sight seems prepared to put the boot in on his government. The most immediate threat should come from the unions. But the spectre of crisis is driving them towards the government, not away from it. The union representatives on the National Economic Development Council -including some who are alleged to be ‘left’ – agreed in the first week in December to reopen discussion with the Tories on how to deal with the crisis, and the Financial Times has been able to note that

‘This is a time when all save the most irresponsible leaders can reasonably be expected to appreciate that the well-being of their own members depends very much on a moderate approach during the national crisis.’

The attitude of many union leaders was summed up by Ray Buckton of ASLEF, when he was asked by a TV interviewer why his executive had sanctioned official action. ‘Because otherwise we would lose control of our members,’ was his reply. For such leaders, the main aim in the present crisis is to keep the support of at least a section of their rank and file while avoiding any action which would push the system within which they themselves operate into more serious crisis. Even the left in the miners’ union has not pushed seriously for a policy that would ensure the defeat of the Tories’ wages policy.

According to Tribune’s industrial correspondent a ‘communist member of the executive’ told him ‘we don’t need a strike ... if anyone does it’s the employers’, a line which was reiterated by two non-communist ‘lefts’,

‘We’ll do everything we can to jump on anything that might lead to strike action at any particular pit. We don’t want it to go further. The best way to win this one is the overtime ban.’

Now, clearly, the overtime ban may lead to victory. It all depends on exactly which of the conflicting reports about the state of coal and oil stocks is correct and just how much coal the electricity generating board manages to buy abroad. But it should be equally clear that there is a fair possibility that the overtime ban alone may not be successful. If the government succeeds in saving energy with its emergency regulations, the imposition of three day working in industry, cutbacks in steel production and so on, then it might be able to hold out until the demand for coal drops off in March. At that point, the right wing in the union would argue that industrial action was not being effective, money would be short in the mining villages and the men might be prepared to settle. For left wing militants in the industry, the need is to argue for all out industrial action now. There is no other adequate response to the government’s measures to conserve coal stocks.

The most remarkable aspect of the crisis, however, has been the virtual silence of the men who the press used to treat as the ‘terrible twins’ – Jack Jones and Hugh Scanlon. Jones’ union has just pushed through the Hull docks a pay agreement that accepts the limitations of Phase Three – although rank and file dockers nationally have shown a willingness to fight for more. And Scanlon has been telling members of his engineering union that it cannot afford an all out strike for its claim of £10 a week on minimum rates and a 35 hour week. Instead, it seems that the tactic to be used is an overtime ban – hardly an effective measure when industry is faced with lay-offs and short time working.

Such vacillations are not accidental. They flow from the realisation on the part of the whole bureaucracy that a harder push by the unions will weaken the system still more. All the national union leaders take it for granted that they operate within the system and intuitively accept that they can only operate successfully, if the system itself enjoys success.

NO-ONE can know in detail how things are going to turn out in the weeks and months ahead. Even the minister responsible claims not to know what the stocks at the disposal of the oil companies are and press figures on the coal stocks change daily. But some points are clear.

The government is trying to scare the union leaders into helping it out and has enjoyed a fair amount of success. But that does not guarantee that it will succeed in holding back the pressure on wages. If the miners go to a strike, it will be compelled to give in in a matter of days rather than see British big business lose the last chance of improving its market prospects.

In this situation, the Tories’ own scare talk can force them to go further than perhaps they would like in confronting the unions. They may be pushed into declaring a total wage freeze without having the power to impose it against rank and file militancy. That would inflame still more militancy, without solving British capitalism’s problems. Again, a general part of the ‘scare’ atmosphere can be attempts at legal action against pickets, as at Birmingham and Shrewsbury.

At the same time, individual employers are going to use the talk of ‘emergency’, the short time working and any redundancies as an opportunity to strengthen their hold over the workforce and weed out individual militants. As one of the heads of GKN told the Financial Times,

‘I feel that the coming recession could be something of a blessing in disguise. I think it will enable us to concentrate on cost reduction and efficiency improvement.’

For socialist militants, however, the period ahead should be one of unparalleled opportunity. The system is visibly in crisis. Yet the traditional social democratic panaceas completely lack credibility: the trade union leaders move closer to the Tories the more the Tories’ difficulties increase and the Labour Party has been administering the system at the national and local level for too long to be able to present itself to militants as a credible alternative.

Our reaction to the crisis has to be at a number of levels. Firstly, we have to emphasise in argument and propaganda that the crisis flows from the logic of capitalism itself, from a social system that needs desperately to be replaced.

Secondly, there has to be agitation within the trade union movement for solidarity with the miners, for a refusal to accept any loss of pay as a result of the two day a week lock-out, and for those other unions with claims pending to take action now, not wait for the miners to either win or lose. It has to be emphasised that the position of the government has never been weaker and that if the Tories get a new lease of life, the responsibility will lie with those union leaders who refuse to mobilise their members now.

But it would be wrong to leave things at that. It will not be good enough merely to prove that the union bureaucracy will not fight. In default of action from the official union movement nationally, militants will have to organise to resist the government’s measures and the effects of the crisis at the shop floor level.

The key thing will be to shift rapidly for one demand to another as the situation changes – from the defensive to the offensive, from the economic to the political, and back again. Built into any period of rapid change, with continual economic and political flux, is the danger of not making the necessary adjustments quickly enough, of setting demands so far ahead that they do not relate to the current struggle, or of behaving according to an outdated routine, so as to lag behind the tempo of the movement.

There is no easy, mechanical way of avoiding these dangers. They arise precisely because capitalism is entering into a period of crisis with the working class movement still fragmented in terms of organisation and consciousness as a result of the experiences of 30 years of capitalist expansion. To generalise on the basis of such fragmented experiences in a period of crisis and flux necessarily involves flexibility and initiative, rather than easily memorisable general slogans. But that leaves the danger of dragging behind the movement of the class, even at the local level. The only way to deal with that danger is by building a strong revolutionary organisation, with branches in the factories, pits and mines, so that it is not a question of isolated militants arriving at tactical demands, but of workers with a shared perspective of generalising the struggle discussing what is best to do.

Last updated on 18 November 2009