A Socialist Worker pamphlet.

First published October 2008 by the Socialist Workers’ Party, PO Box 42184, London SW8 2WD.

Transcribed by Christian Høgsbjerg.

Marked up up by Einde O’Callaghan for the Marxists’ Internet Archive.

“BLACK MONDAY, terrible Tuesday, wicked Wednesday.” So one popular newspaper described the events of the third week in September. People across the globe looked on bemused and frightened as the great financial corporations whose colossal profits and huge bonuses have characterised the last three decades floundered in a morass of debt. Many spectators could not conceal a chuckle at the sight of expensively suited yuppies saying goodbye to their mega salaries as they emerged from skyscraper offices carrying cardboard boxes of personal possessions. But along with the chuckle there was a deep anxiety. The system which we live and work in was in deep crisis, and tens of millions with mundane jobs and humble living standards worried about whether they would be paying the price. That fear deepened in the week that followed, as one of America’s richest men warned of “an economic Pearl Harbour” and George W Bush made a special TV broadcast warning that “our entire economy is in danger”.

Some have already paid the price. A thousand people a day joined the lines at Britain’s job centres in August. Some 85,000 holiday makers arrived at airports to find that flights they had already paid for no longer existed, with police prepared to turn them away if they tried to take them. Two million Americans have lost their homes in the last year. No one knows what will happen next, least of all the politicians, bankers and industrialists who assure us that they are the best people to run society in our interest.

Behind the crisis lies a word they have succeeded in virtually barring from polite society for nearly three decades – the word is “capitalism”. Instead they have fed us with talk of “entrepreneurship”, and “wealth creators” we are meant to stand in awe of, allowing them to run the Bank of England independently of elected governments, to take over schools as city academies, reorganise NHS trusts and foundation hospitals, begging them to sponsor football teams and symphony orchestras, relying on them to finance a political party that once claimed to challenge their influence. Now the crude reality hidden behind the euphemisms has suddenly been exposed. It is the reality of a system based upon competition to see who is the greediest, its stars those most adapt at making money at the expense of everyone else, knowing that if things go wrong for them they can rely on politicians who claim to stand for free enterprise to provide them with gigantic state handouts while clamping down on the pensions and unemployment benefits of the rest of us. This is what the US state did on 7 September when it took over the two mortgage giants Fannie Mae and Freddie Mac, spending several hundred billion dollars on what was, according to the New York economist and former government adviser Nouriel Roubini, “the biggest nationalisation humanity has ever known”. It was what the US government did again nine days later when it took over AIG, until recently the biggest insurance company in the world – and it is what the British government did nine months before when it finally took over Northern Rock, and again in September when it nationalised the former building society Bradford and Bingley.

The takeovers were the biggest refutation conceivable of the free market, “ne-oliberal” language which such politicians and media commentators have inflicted on us. They have been forced by events to repudiate everything they have said for decades, ripping up almost overnight the ideology they have preached at workers and poorer countries.

Why? Not to protect those who are losing their jobs, their homes or have seen their holidays ruined or their pensions put at risk. Northern Rock, since the state takeover, is at the head of the league of mortgage companies that are forcing people out of their homes through repossessions – it took away ten families’ homes each day in August. The protection has been for the financial system that produced the crisis – a system based on multibillion hedge funds, banks and investment funds assuming that no one would ever dare refuse their endless greed. The US government did allow one of the most prestigious investment banks, Lehman Brothers, to go bust on 14 September. But the wild behaviour this led to from the hedge funds, banks and investment funds forced it to do a rapid U-turn and cough up many billions more on 15, 16 and 17 September. The most right wing US administration for three quarters of a century turned to nationalisation on an unparalleled scale to protect the rich, socialising losses after 30 years of privatising profits. No wonder pro-capitalist economist Willem Buiter describes what has happened as “the end of American capitalism as we knew it”.

The key question is what is going to replace it.

“Stand on your own two feet,” has always been the advice the defenders of capitalism have given to those who suffer when firms are “downsized”. It is the excuse for forcing people to compete for their own jobs, for the unemployed to suffer humiliation at the job centre, for single mothers and the disabled to be tested for employability before getting benefits, for telling those who have never had decently paid jobs to save if they want pensions, for students to work to keep themselves as they study and to pay off vast sums in fees after they finish. “There is no alternative” was the slogan of Margaret Thatcher, taken up by Tony Blair and Gordon Brown as they invited her to Downing Street and Chequers. The worst thing conceivable, they told those who lost their jobs with the collapse of electronic firms in Scotland’s Silicon Glen or in the car industry in Dagenham, or Longbridge in Birmingham, would be for the state to take control of things. It would destroy “competition”, “stifle initiative” and “thwart aspiration”. Now they praise the state for intervening and taking over – but only so long is it does so to protect those who have gambled on the financial markets and lived at levels of stratospheric luxury in wealth created by others while creating nothing themselves except enormous debts.

THERE IS one simple explanation for the cause of the crisis – the greed of those with money to get more money. This is not just the reason given by those of us who have always opposed capitalism. It is the explanation from some of its most ardent supporters. John McCain blames “speculators and hedge funds” who “have turned our market into a casino”. The Daily Express, owned by a millionaire pornographer, denounces “the excesses of the City of London” and “the spivs” who are “destroying Britain”. Former International Monetary Fund chief economist Raghuram Rajan blames the vast bonuses bankers receive. Martin Wolf, senior columnist for the City’s own Financial Times and who just three years ago wrote a book called Why Globalisation Works, blames the “irresponsibility” of bankers.

Finance’s destructive role has been quite simple. In its pursuit of profit it scoured the globe looking for opportunities to lend money so as to reap vast amounts in interest payments, undertaking speculation, and raking in fees from overseeing takeovers and privatisations. In the 1970s and 1980s this had focused on the poorer countries of the world – lending them so much at such high interest rates that in order to keep up their repayments they were forced to borrow more at even higher interest rates. When such countries ran into trouble, the US, British and European Union governments sent in the IMF to bend them to its will, forcing them to open up their markets to giant Western firms, to sell off their industries to them, to privatise healthcare and to force the poorest parents to pay for their children’s education. But there were limits to what could be squeezed out of such countries, precisely because they were so poor. Increasingly finance turned its attention to the richest countries – and in particular to the profits that could be made through speculation on stock exchanges, in commercial property, in commodities like oil, in pension funds, and, above all, in housing.

The sums to be made from such money lending could be spectacular – so spectacular that the pieces of paper containing indebted people’s promises to pay what they owed became very valuable. Mortgage companies would sell these to banks, who would then parcel them together into what they called “financial instruments” and sell them to other bankers at a profit. Groups of very rich individuals would chip in few million each to set up hedge funds to join in the action. A whole industry employing hundreds of thousands of people across the world grew up around such deals.

Those who were at the centre of this industry and reaping its greatest rewards were praised as “go-getters”, “innovators” and “entrepreneurial geniuses”. Among these geniuses were those running the British bank Northern Rock. The Financial Times has told how it was “the toast of a glitzy City dinner where it was heaped with praise for its skills in financial innovation”.

The profits from lending, parcelling the debts and then selling them spurred a search for ever new fields of lending and sources of profit. The market for doing so in established ways began to get sated. So it was that the geniuses stumbled on the “subprime” market. This referred to people who had low or insecure incomes and who had usually been refused credit in the past. But now there was the great temptation of making more profits by lending them money to buy things they needed desperately – especially homes. Offering them mortgage loans at initially low interest rates could make them sign up to debt, with the interest rates then forced up in a very profitable way after two or three years. Mortgage companies like Northern Rock saw this as a way of making profits on which they could not lose. There were big profits to be made if the subprime borrowers were able to pay the increased interest rates. And there were big profits to be made if they were unable to, since their homes could be repossessed and sold as house prices kept rising. The lure of such profits beguiled all who saw them. Everyone in Wall Street and the City of London wanted to join in, borrowing vast sums in order to buy the parcels of debt and assuring other banks or hedge funds that lent them money to do so that they would always be able to repay what they owed because they themselves were owed so much.

Anyone with any sense should have been able to see that the game was bound to come to a sudden end at some point. What was forcing up house prices was precisely the frenzied competition between mortgage companies to lend to the poorest people. Any small increase in the inability of people to keep up with their mortgage payments would cause a surge in the number of repossessed houses for sale. Then house prices would start falling and everyone involved in the subprime mortgage business would start making a loss. This is what began to happen in 2006, with a small increase in US unemployment and a big increase in US interest rates. But those involved in the chains of borrowing and lending ignored the warning signs. That was, until the second week in August 2007 when suddenly it became apparent that hedge funds owned by banks could not recoup what they had lent so as to pay back what they owed. Every bank now feared that it would not be able to get back money lent to other banks. The frenzied game of borrowing to lend came to a sudden halt. It was not possible even for the financial “masters of the universe” to continue indefinitely with lending money they did not have to people who could not pay it back.

Not only subprime mortgage lending was hit. So too was normal mortgage lending. It fell enormously in volume – by half in Britain – and what lending did take place was at higher interest rates. But that meant that all sorts of houses could not be sold house prices began falling even more rapidly, repossessions rose as people were unable to pay raising interest rates, and it became even more difficult for banks and hedge funds to recover the vast sums they had lent.

The poison spread from one part of the financial system to another. There were not only those who had lent to make the loans. There were also those whose greed led them to put their faith in the profits to be made from insuring the loans of the banks and hedge funds. The sums involved in all these different forms of gambling were immense. Transactions in the “credit derivatives” market were estimated to amount to an incredible $62 trillion in September 2008, tying up $1,000 billion or more of cash.

So long as the mountain of debt had produced profits, there was nothing but praise for those who ruled over the financial system from newspaper columnists, governments and New Labour politicians of both the Blairite and Brownite variety. The New Labour government gave an honorary knighthood in 2002 to the man who, more than any other, had encouraged the frenzy of greed Alan Greenspan, then head of the US Federal Reserve Bank, for his “contribution to global economic stability”. Now this greed is damaging the rest of capitalism.

Every form of business in a capitalist economy involves borrowing and lending, with firms that provide goods granting credit to wholesalers, wholesalers granting credit to retailers and retailers granting credit to those who buy many sorts of consumer goods. The sudden fear banks had of lending to each other – the “credit crunch”, as it came to be called – threatened to bring all this to a halt. It was described as the equivalent of a heart attack for the capitalist system. That is why governments and central banks forgot all their preaching about the virtues of untrammelled free competition and intervened to try to keep the financial system intact.

The sums were already immense – the US state poured $400 billion into the financial system in March and April 2008 as the first big US bank, Bear Stearns, was on the verge of going bust. For a few weeks this calmed things down. Some believed the crisis was over. Republican presidential candidate John McCain asserted at the beginning of September that the US economy was fundamentally sound. Such people were deluded by their own faith in the system. In the end the most right wing US administration in three quarters of a century decided that only massive state action could protect the whole capitalist system from itself and took over the two giant mortgage companies Fannie Mae and Freddy Mac. A last attempt to leave things to the market by allowing the one of the four prestigious investment banks, Lehman Brothers, to go bust only succeeded causing such turmoil as to threaten an unprecedented financial collapse, with commentators of all sorts speaking of the worst crisis since 1929. The state had to carry through another massive nationalisation,that of the insurance giant AIG, and George Bush had to warn, amid accusations of “socialism” from his own party, that the whole system would collapse if the state did not buy up all the dubious packages of debt for an estimated $700 billion dollars.

Now attempts are being made to give the impression that it was only the financiers that were to blame, that the rest of the system is innocent. Don’t worry, some commentators say, it is only finance that is in crisis. The “real economy” is something quite different. Typical was the real message of Gordon Brown’s much praised speech to the Labour Party conference. There was, he said a need to clean up the City of London. But he hastened to add that London had to “retain its rightful place as the financial centre of the world”, telling a TV interviewer the next day that Labour remains a “pro-business government”

But finance is not something separate from the rest of capitalism. It is driven by the same blind competition for profit. The biggest industrial firms have turned to finance in order to boost their profits in recent years – General Electric, the biggest manufacturing firm in the US, has done so, as have Ford and General Motors. The boards of the big financial concerns include rich industrialists. Lehman Brothers directors included: the former chair of IBM, the former head of Halliburton, the former head of the media group Telemundo (who is also a director of Sony and MGM) and the current chair of GlaxoSmithKline (who is also the former head of Vodaphone) as well as a retired US navy admiral (also leader of the American girl scouts), the former head of the art auction house Sotheby’s and the former head of Salomon Brothers. The board of the biggest investment bank, Goldman Sachs, includes directors of General Motors, Mobil Oil, Novartis, Kraft Foods, Colgate Palmolive, Du Pont, Boeing, Texas Instruments and ArcelorMittal.

Greed does not know any frontier between finance, industry and commerce and, for that matter, culture and brainwashing youth in the virtues of militarism. It has not just been financiers who have expected to make enormous profits and get gigantic salaries in recent decades. So too have all those who own and control industry on both sides of the Atlantic. In the US, according to CNN-Money, “the ratio of CEO salary to average wages increased from 301–1 in 2003 to 431–1 in 2004. The current ratio is much higher than it was in 1990, when it was 107 times more than the average worker’s pay. It is much higher than in 1982, when the average CEO made only 42 times more than the average worker.” In Britain, New Labour’s John Hutton rejoices in such inequality. “Rather than questioning whether high salaries are morally justified,” he wrote in April, eight months into the financial crisis, “we should celebrate the fact that people can be enormously successful in this country.”

THE CRISIS which has erupted in the financial system of the last year is not some completely new phenomenon.

The history of industrial capitalism has been a history of booms and slumps – of what establishment economists call “the business cycle”. For nearly 200 years spells of frenetic expansion of production have been interspersed with sudden collapses, in which whole sections of industry grind to a halt.

The world has experienced four such major crises in the last quarter of the 20th century and many lesser ones. Each has imposed terrible burdens on those who work within the system, devastating many people’s lives as they lose their livelihood – and sometimes their homes as well. Such crises are not some minor product of financial irregularity, but are built into the way the system runs.

This is something the mainstream economics that is taught in schools and colleges and accepted by the vast majority of media commentators has never been able to come to terms with. This failure is built into the very method of mainstream economics. It sees capitalism as a system concerned with satisfying human needs – what it calls “utility”. It therefore cannot understand how there could be a sudden shutting down of whole areas of production while there were people prepared to work, materials for them to work on and people who wanted the goods produced.

The explanation is simple. The driving force of capitalism is not the satisfaction of people’s needs, but the competition between capitalists to make profits. Human needs are only satisfied insofar as doing so contributes to the profit drive.

In all human societies people have had to labour together to get a livelihood from nature. In some societies small bands of people have gathered fruits, dug up roots and hunted wild animal; in others villagers have worked the land to grow crops.

Today the level of cooperation involved in providing for people’s livelihood is greater than ever before. If you examine the clothes you are wearing you will see that. There will be cloth made of wool produced in one part of the world, cotton goods from another, artificial fibres ultimately originating in oil drilled from the ground somewhere else, all conveyed on ships or aircraft operated by people from a host of different nationalities. Each of us can only survive because of the labour exerted by many thousands of people right across the world. The system we live in is, in reality, a network of collaboration between the six or more billion people who make up the global population. But the organisation of the network is based upon a very different principle to that of cooperation. It is under the control of privileged minority groups who control the tools, machinery and land needed for production. Anyone else who wants access to these things in order to get a livelihood has to work for them on terms they dictate. And these privileged groups are in competition with each other with the undisguised aim of profit. If production does not contribute to helping such capitalists achieve their goal, then it does not take place, however massive the hardship caused.

The apologists for capitalism justify such profits in two main ways. They claim that profit is the “reward” the capitalists get for “abstinence” from consumption, although capitalists consume massively more than those they employ. They also describe profit as the reward for their “enterprise”, although for the great majority of today’s capitalists enterprise is restricted to the reading of profit and loss accounts, since all technical research is carried out by people they employ on much lower salaries than their own. What matters is knowing how to register the patents, not how to discover the drugs, write the software or extract the oil.

The man who is usually quoted as the father of capitalist economics, Adam Smith, was more honest than his present day successors. Writing at a time when industrial capitalism was just taking off, in the late 18th century, he recognised that it is labour that enables humans to get wealth from nature, and profit therefore can be nothing other than stolen labour which a privileged group can grab from the rest of us through its control of the tools, machinery and land needed for production. Smith was not consistent in his views, but his writings prompted a young Karl Marx to develop an account of capitalism which was also a critique of capitalism.

Marx saw that competition between capitalists to sell goods produced by exploiting the labour of others necessarily resulted in a whole system that escaped from human control and turned against those whose labour sustained it. What supporters of capitalism call the “laws of the market” are in fact forms of compulsion that arise from a system that is like a Frankenstein’s monster that has turned against those who have created it. Marx called this process “alienation”.

However, the system does not only escape the control of those who labour within it. It also escapes to a very great degree from the control of the capitalists themselves. Each time one capitalist succeeds in accumulating and expanding the means for producing wealth, other capitalists are forced to do the same if they want to stay in business. Competition means they have no choice but to accumulate. They have to accumulate in order to make profits and make profits to accumulate, in an endless process. And that means they have to exert a continual downward pressure on the wages of those who work for them – and an upward pressure on the intensity with which they expect them to work.

They can choose to exploit their workers in one way rather than another. But they cannot choose not to exploit their workers at all, or even to exploit them less than other capitalists – unless they want to go bust. Capitalism is indeed a rat race, and in more ways than one: any capitalist who is not a rat, who tries to treat workers well, putting their needs above the drive to compete, does not last for long.

The inability of capitalists to control their own system shows itself in other ways as well. Its blind competition inevitably creates conditions which threaten to throw it into chaos. The production of rival firms is linked by the market. No one capitalist can keep production up unless he can sell his goods. But the ability to sell depends on the spending of other capitalists – whether on luxuries for their own consumption, on new plant and equipment, or on wages which their workers will use in the shops. The market makes production anywhere in the system dependent on what is happening everywhere else. If the chain of buying and selling breaks down at any point, then the whole system can begin to grind to a halt. Then an economic crisis results.

Each firm is out to maximise profits. If profits seem easy to make, then firms throughout the system expand their output as rapidly as possible. They open up new factories and offices, buy new machinery and take on employees, believing they will find it easy to sell the goods that are turned out. As they do so, they provide a ready market for other firms, which can easily sell machines or buildings to them or consumer goods to the workers they’ve employed. The whole economy booms, more goods are produced and unemployment falls.

But this can never last. A “free” market means there is no coordination between the different competing firms. So, for example, car manufacturers can decide to expand their output, without there being at the same time any necessary expansion by the firms that make steel or the plantations in Malaysia that produce rubber for tyres. In the same way, firms can start taking on skilled workers, without any of them agreeing to undertake the necessary training to increase the total number of such workers. All that matters to any of the firms is to make as much profit as possible as quickly as possible. But the blind rush to do so can easily lead to the using up of existing supplies of raw materials and components, skilled labour, and finance for industry.

In every boom that capitalism has ever experienced, a point has been reached at which shortages of raw materials, components, skilled labour and finance suddenly arise. Prices and interest rates suddenly begin to rise and this in turn encourages workers to take action to protect their living standards.

Booms are usually accompanied by unexpected inflation. And, more seriously for the individual capitalists, rising costs suddenly destroy the profits of some firms and force them to the edge of bankruptcy. The only way for them to protect themselves is to cut back production, sack workers and shut down plants. But in doing so they destroy the market for the goods of other firms. The boom suddenly gives way to a slump.

Suddenly there is “overproduction”. Goods pile up in warehouses because people cannot afford to buy them. The workers who have produced them are sacked, since they cannot be sold. But that means they can buy fewer goods, and the amount of “overproduction” in the system as a whole actually gets greater, deepening the crisis.

The turn from boom to slump always takes big business by surprise. As Marx noted, “Business always appears thoroughly sound until suddenly the debacle takes place.” The crash always comes – and with it a massive devastation of people’s lives and a massive waste of resources.

So in the last big recession in Britain, in the early 1990s, the economy produced in each year at least 6 percent less than it could have done – leading to a total loss of about 36 billion of output each year for nearly three years. To put it another way, the loss each year was nearly as much as the cost of the National Health Service. That recession was less serious in the US than in Britain. Nevertheless, its output loss was more than 50 billion dollars a year. If it had grown modestly, there would have been an extra 150 billion dollars of output a year – a figure equal to that which the whole black population of sub-Saharan Africa had to live on.

Yet the response of employers and governments to the slump was always to tell people that there was “not enough to go round”, and that “everyone has to make sacrifices” and “tighten their belts”. It is already a message we are hearing in the present crisis, with the New Labour chancellor Alistair Darling telling delegates at the TUC that because of the crisis wages in the public sector could not possibly be allowed to keep up with prices.

The means of producing the things people desperately need continue to exist just as much in the midst of an economic crisis as before – on the one side the factories, mines, dockyards, fields, etc. capable of turning out goods, on the other the workers capable of labouring in them. It is not some natural catastrophe which stops unemployed men and women working in the closed down industries, but the organisation of capitalism.

THE DRIVING force of capitalism is profit. Not just the amount of profit, but how that relates to what amount capitalists have paid out for investment in plant and machinery – the rate of profit. Accumulation, as each capitalist tries to keep ahead of every other, means that over time such expenditure on plant and machinery grows ever bigger, and grows faster than any increase in the number of workers employed. But that means that to maintain the rate of profit the amount of profit the capitalist makes has to grow ever greater. It is rather like someone who moves from driving a small car to a bigger one. It is no good filling the tank with the same quantity of petrol as before; if more petrol is not put in, the car will run out of petrol and grind to a halt before its journey is complete.

But the source of profit is labour. Accumulation means more plant and machinery being used for each worker employed. So investment rises more quickly than the source of the profit need to sustain it. Capitalists have ways of countering this trend. They can increase the profit per worker by forcing wages down and increasing the pressure on workers to toil harder and for longer hours (American capitalism has used both methods over the last 30 years and European capitalists are trying to do the same). They can also hope that the things workers consume will get cheaper, so enabling them to take more profit per worker without the workers complaining too much about falling living standards. But over time, Marx pointed out, they would not be able to avoid problems caused by the downward pressure on profit rates. In particular each crisis would be likely to be worse than the one before.

Marx did however, point to one way for some capitalists to solve the profit rate problem. That was buying up on the cheap the plant, equipment and materials of other capitalists who went bust in the crisis. The dog eat dog logic of capitalism would be accentuated by the crisis, but this in turn would restore profit rates for those who survived it and enable them to enjoy a new spell of prosperity.

This process of restoring accumulation through crisis was, for Marx, a sign of the inhumanity of capitalism. But for some right wing economists the argument has been turned, amazingly, into a defence of capitalism. However much people may suffer in the here and now, they say, in the long run things will get better. The crisis is like a purgative, clearing out all the poison of unprofitability from the system. This was the argument put forward during the slump of the 1930s by Friedrich von Hayek – a free market conservative who recognised that Marx had been one of the first to analyse the capitalist crisis. The slump, he said, would have solved itself if it had not been for government intervention that distorted the market and prevented wages falling sufficiently to restore profits. A similar argument was put forward by another pro-capitalist economist who was not quite so right wing, Joseph Schumpeter. Capitalism expanded, he said, through “creative destruction”. This phrase is still used today by economists and politicians who believe economic crises are necessary, however unpleasant their effects might be on the mass of people.

What such people fail to see is the implication of something else Marx pointed to. As capitalism gets older, it is marked by the increasing importance of a relatively small number of very big firms – what he called the concentration and centralisation of capital. Each crisis increases this tendency as it causes some firms to take over others. But the bigger firms are, the more damage is done when they are bankrupted by crisis. The harm is not only to themselves, but to other firms, big and small, who supply them with materials and components. A single unprofitable big firm going bust can destroy the market for other, until now very profitable, firms.

It was this process which lay behind the intensity of the economic crisis that broke worldwide in 1929. As the collapse of one firm or bank led to the collapse of others, far from the crisis resolving itself, it got worse. Even the most ardent supporters of capitalism found it hard to believe that the response to the crisis should be to do nothing.

By 1933 most capitalists governments – and many big capitalists – rejected the “hands off, let the crisis do its worst” approach. Everywhere there was, to a greater or lesser extent, a turn to state intervention in the economy, what was often called “state capitalism”. In Japan under a military-dominated government and in Germany under the Nazis, growing arms expenditure served to mop up unemployment. In the US the Roosevelt administration implemented its “New Deal” schemes to try to bring capitalism back to health – fixing high prices for farm products so as to stop bankruptcies among farmers, buying up busted banks, using public works schemes to give work to some of the unemployed, even encouraging unions in the hope that higher pay might lead to firms being able to sell more goods. Yet all its efforts had very little effect. There was some economic recovery from the lowest level, when output was half the 1928 level. But that still left more than 14 percent of people unemployed in 1936 – and then in August 1937 a new economic decline began.

The slump did eventually come to an end. But the cause did not lie in Roosevelt’s New Deal. Almost all the mainstream economists had a single answer to the real cause – the Second World War. As John Kenneth Galbraith put it, “The Great Depression of the 1930s never came to an end. It merely disappeared in the great mobilisation of the ’40s.”

But the experience of the 1930s and the war did lead to a very important shift in the ideology of capitalism. State intervention – state capitalism – was now seen as the way to avoid future destructive crises. There was widespread acceptance of arguments put forward in the mid-1930s by the British economist Keynes. Crises, he insisted, were caused by spending on investment and consumption not being high enough to buy all the goods that had been produced. Cutting wages and allowing firms to go bust could make things worse by reducing the demand for goods still more. Governments should intervene by cutting interest rates and increasing their own spending. More goods could then be sold, production would expand, more people would be employed and governments would then be able to recoup what they had spent through higher tax revenues. Such “counter-cyclical”, “monetary” and “fiscal” measures were the answer to crisis. At some points Keynes came close to more radical conclusions. He put forward a theory of his own as to why profit rates were low (as, for that matter, did the arch-conservative von Hayek) and he suggested that it might be necessary for governments to “socialise investment”. But he did not develop these notions, and in practice his suggestions for dealing with the crisis of the 1930s were very limited in scope, as is emphasised by his biographer Skidelsky – and studies since suggest they would only have had a very limited impact.

But in the aftermath of the world war, with the memory of the slump still in people’s minds, capitalism found Keynes’s ideas very congenial. They seemed to show a way of avoiding further slumps – and they were a very good counter to any ideas of socialist revolution. What was the need for thoroughgoing socialism, the argument went, if capitalism could be stabilised to provide people with higher living standards through limited state intervention? Conservative as well as Labour politicians in Britain accepted Keynes’s approach, and by 1970 US president Richard Nixon could say, “We are all Keynesians now.”

The appeal of Keynesianism was strengthened by the fact that there was a long period – 35 years in the case of Britain, 25 years in the case of the US – without normal economic crises, let alone anything approaching the slump of the 1930s. People assumed this was result of the governments implementing Keynesian methods – and many moderate critics of capitalism today, like the Guardian’s economics editor Larry Elliot, still make that assumption. Yet this view has not withstood empirical investigation. Most governments did not use Keynesian methods, and the few that did only rarely.

What kept the boom going was not Keynes, but the same thing that had brought the slump of the 1930s to an end – massive arms spending. The spending was not on the same scale as during the Second World War, but it was still vast in the case of the US and to a lesser extent, Britain and France. In the 1930s the US has spent less than 1 percent of its national income on arms; in the early 1950s it spent 12 percent – as much as was spent on investment in industry. Such spending by what was sometimes called “the permanent arms economy” pulled the US economy forward – and provided an export market for countries such as West Germany and Japan which had a much lower level of arms spending (for a more detailed explanation of the permanent arms economy, see my book Explaining the Crisis, Bookmarks 1999). As the Palestinian-British Marxist Tony Cliff put it at the time, the post-war boom was balanced on the cone of the H-bomb.

This way of sustaining capitalism seemed to work wonders for a time. The rate of profit, which had risen during the war, stayed fairly high. Economies grew at rapid speed, living standards rose, and when British Tory prime minister Harold Macmillan used as his election slogan in 1959 “You’ve never had it so good”, most people accepted what he said however grudgingly.

Yet military spending proved to be only a short-term solution to the economic evils of the system. The US reduced the proportion of its national income going into military expenditure in the face of economic competition from Germany and Japan, until it was half what it had been. By the late 1960s profits rates were beginning to fall in their old way (see box).

Profit rates and investmentUS Marxist Robert Brenner has shown that American manufacturing profits rates fell from 24.8 percent in the years 1949–1969 to 13 percent during 1980–1990. They made up some of the loss in the decade 1991–2000, rising to 17.7 percent, before falling to 14.4 percent over 2000–2005. Japanese manufacturing profit rates more than halved from the 1960s to the 1990s, and in Germany they fell by 75 percent. The fall in profit rates was accompanied by a decline in the growth of fixed investment – in the US from over 4 percent a year in the 1960s and 1970s to 3.1 percent in the 1990s to 2.1 percent in 2000–2006; in Japan over the same period from over 10 percent to 2.8 percent; in Germany from around 7 percent to 1.6 percent. In the US the proportion of investment going into finance as opposed to production rose from 12 percent in the mid-1970s to 25 percent in the 1990s. In Britain the financial sector grew from about 7 percent of GDP in 1975 to about a quarter in 2000. By then it accounted for around 18 percent of total employment. Investment in finance and business services was less than half that in manufacturing 1975; by 1990 it was four times higher. |

In 1971, and on a much bigger scale in 1974 and 1980 the old pattern of boom and bust reappeared.

At first governments responded by applying the Keynesian medicine they had told everyone to believe in but had rarely used before. They soon found that it did not work. Instead of restoring economies to their old vigour, it simply led to rising prices on top of low or negative rates of growth – what was called, in the jargon of the time, “stagflation”. And inflation had one very important by-product that worried capitalists and governments – it encouraged workers to fight for pay to keep up with prices. Governments abandoned Keynesianism and a new economic orthodoxy took root. Initially it was called monetarism, later neo-liberalism. It held that there was a natural rate of unemployment that government action could not alter, and all that the state should do in the face of economic crises was keep the money supply at a stable level, leaving everything else to the “free market”. Even this was too much for an increasingly influential school of “new classical economists” who argued that money should be left to the free market as well. For one of their leading lights, Nobel Prize winner Edward Prescott, “rhythmic fluctuations” in unemployment are really “counter-cyclical movements in the demand for leisure”. Whereas previously apologists for capitalism had said that state intervention would make it work, now they said that stopping state intervention would do so.

The new neo-liberal approach proved in practice to be no better at warding off recurrent crises than the old Keynesian one had been. The monetarism of the Thatcher government in Brittan in the early 1980s made a bad economic crisis worse, and was eventually abandoned by one of its architects, Tory chancellor Nigel Lawson. In the US the Reagan government’s policy of those years was often called “military Keynesianism”, because it involved a massive new increase in arms spending. Every time it looked as if big firms would go bust, governments forgot their free market ideology and threw them money to keep them in business. Neo-liberalism was something to be imposed on the weak by the strong – on poor countries that had become indebted to the big Western banks, on workers who were told to “get on their bikes and look for work” when made redundant, on workers forced to accept marketisation and compete for their own jobs, on poor people denied welfare. Such methods had beneficial effects for capitalism. In the US real wages were lower in 1995 than they had been in 1970, and across most of the capitalist world profit rates did improve somewhat after 1982. But the improvement was not enough to restore the system as a whole to the health it had known in the 1950s and 1960s. It was here that finance on an unprecedented scale stepped in – and with it the fiddling of figures and the rigging of markets that was to culminate in the great crash of September 2008.

FOR A capitalist economy to function smoothly everything produced throughout the system must be bought. As we have seen earlier, workers can never buy more than a portion of it for their own consumption, because their living standards are held down to create profits This usually means the capitalists have to buy the rest. An awful lot goes to their own, bloated, personal consumption, but more important is their investment in new plant and machinery with the hope of making further profits. If they are not satisfied with profit rates, this investment will not take place at a high enough level for everything produced to be sold.

As we have seen, this results in a crisis of overproduction as a gap opens up between what has been produced and what is being bought. Unless this gap is bridged a slump will be the outcome.

There are, however, other things that can bridge the gap between what is produced and what is bought out of their incomes by workers and capitalists. One is to make a huge push to export goods abroad. Another is arms spending. A third is rising debt that enables people to buy goods they could not otherwise afford.

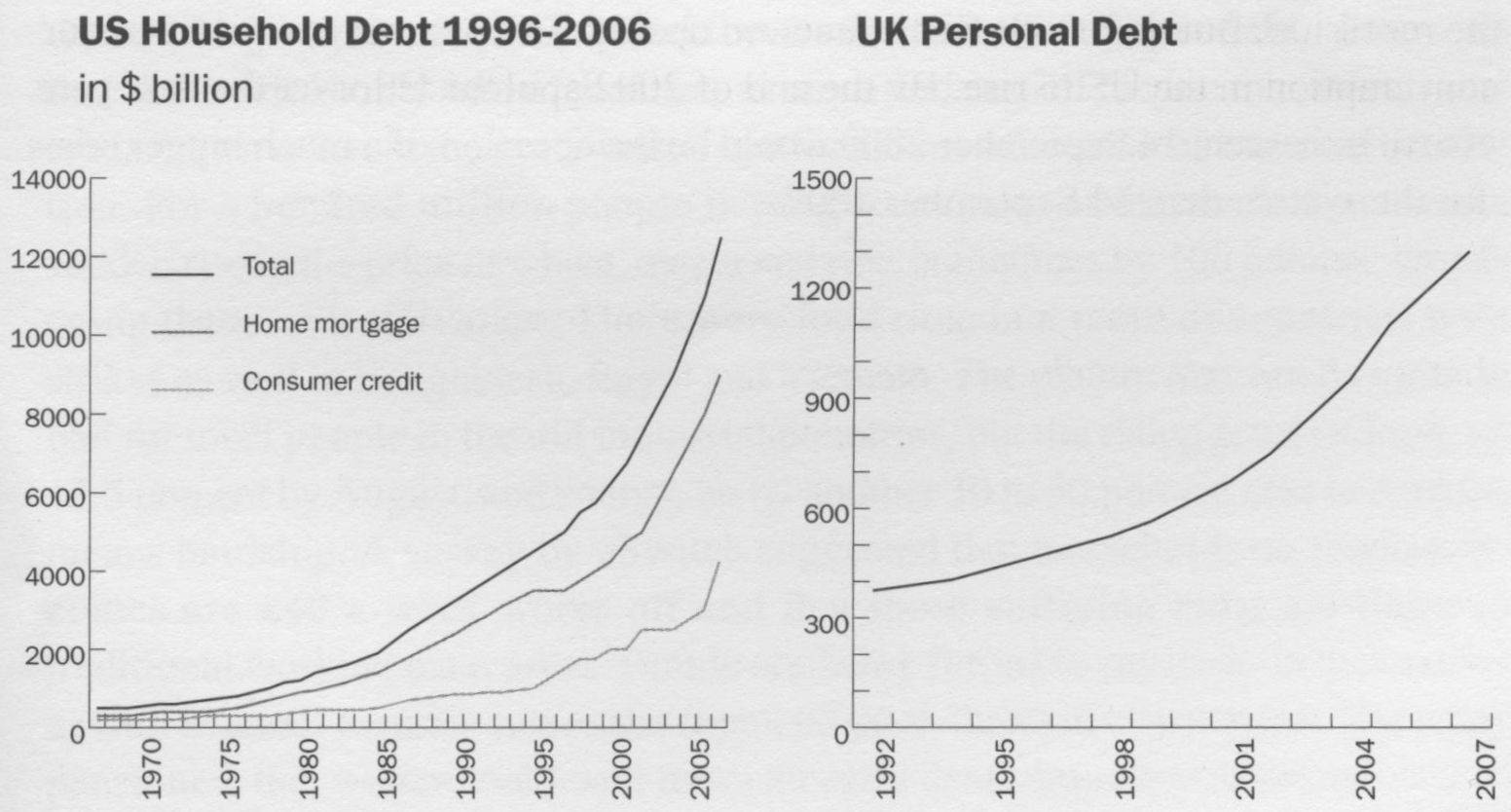

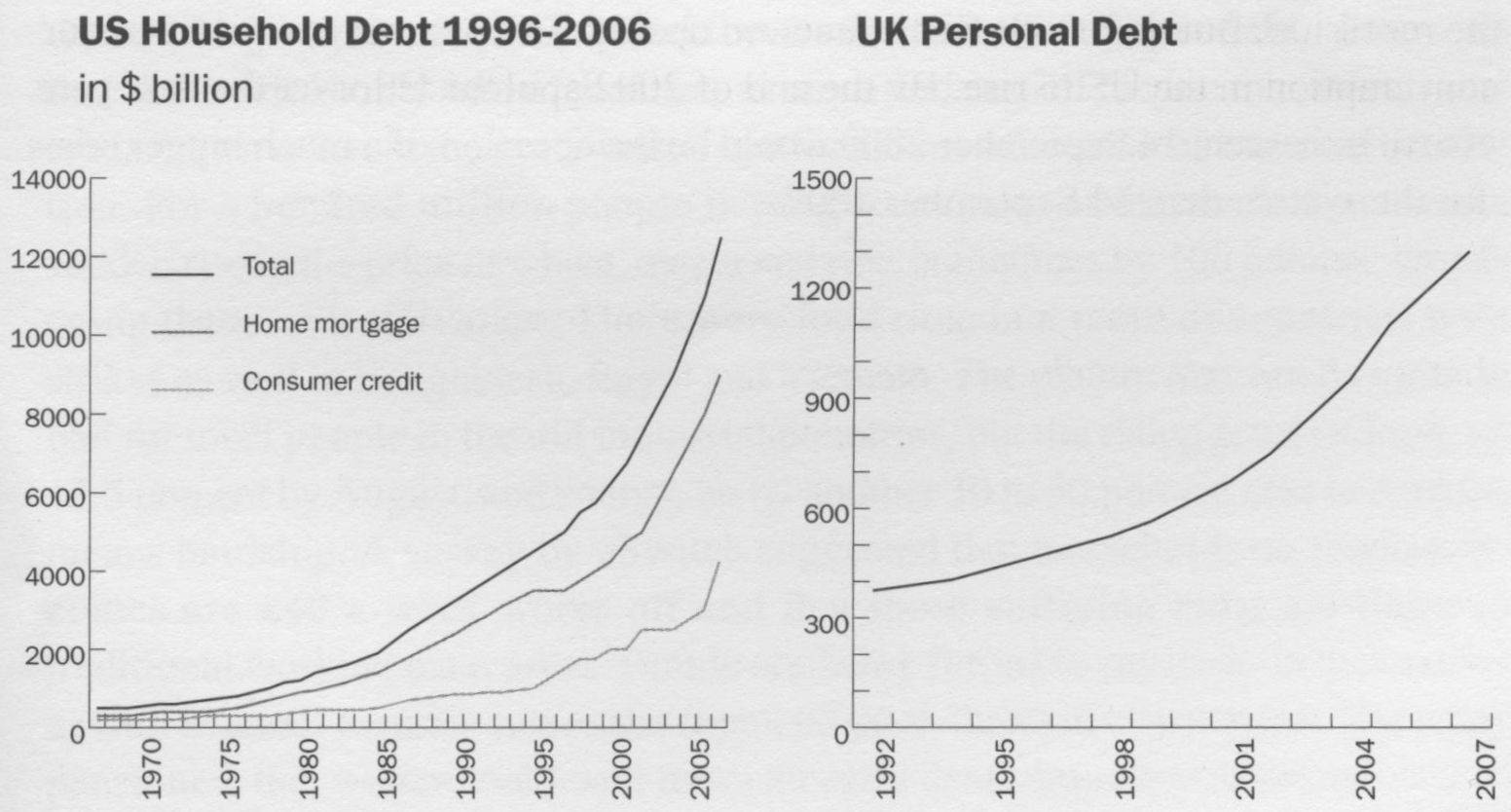

It was this which took off massively in the United States, Britain and some other countries between the 1980s and early 2000s. Total debt grew from being equal to about one and a half times US national output in the early 1980s to nearly three and a half times in 2007. Some of that was government debt, which shot up to finance Reagan’s arms spending in the 1980s and Bush’s in the early 2000s. Some of it was business debt, which rose in the mid-1980s and again in the mid-1990s. A lot of it was personal debt, which rose nearly 20-fold between the early 1980s and 2006. By 2006 household debt in the US was 127 percent of total personal incomes – as against only 36 percent in 1952 and 60 percent in the late 1970s. Some of this was owed by wealthy households, but an increasing amount was owed by workers, whose pay had stagnated or fallen. By the late 1990s and early 2000s consumers in the US were, on average, spending between 2 and 4 percent more than their incomes.

The debt fulfilled two functions for capitalism. It provided a flow of interest payments to boost the profits of capitalists. The share of the financial sector’s profits in US gross domestic product rose more than six-fold between 1982 and the beginning of 2007, and their share of total profits grew from about 15 percent in the early 1950s to almost 50 percent in 2001. By the 1990s General Motors and Ford were turning to finance for to raise the low profits they were getting from actually making things. Between 1992 and 1999 “financial services” provided more than half of General Motors’s profits.

But debt’s other function, of providing a market for things that people, firms, and governments could not afford to buy out of their incomes, became even more important. Put crudely, without increased indebtedness many of the goods capitalism produced could not have been sold and there would have been near permanent recession. It was as if the permanent arms economy of the post-war years had given way to a permanent debt economy.

The debt economy was incredibly wasteful. An increasing amount of wealth was tied up in building huge offices for financial institutions. Finance accounted for a quarter of total fixed investment in the US in the late 1980s and the 1990s. The waste was even greater in Britain under New Labour. Finance and business services grew to account for four times as much investment as manufacturing and other industries and for almost a third of the economy in 2004 with gross value added of £344.5 billion. But neither capitalists nor governments worried about such waste so long as things were going well. They boasted that it was creating prosperity.

In fact, between the mid-1990s and the mid-2000s, 1.5 million manufacturing jobs disappeared in Britain, while between one million and 1.5 million “financial and business services” jobs were created. Catering for the needs of these new workers in turn provided a market for a host of other services – taxis, fast food outlets and sandwich bars, city centre pubs, and so on – many of them offering jobs at pay scales little better than the minimum wage. The new jobs on offer were rarely in the same locations as the old industries that have shrunk. Hence the expansion of employment in London and some provincial cities, while the old industrial areas have usually continued to decline. But even in London the jobs do not solve the problems of much of the old workforce. An inflow of £53 billion in foreign direct investment into London (31 percent from the US and 16 percent from India) did not stop much lower than average levels of employment in boroughs such as Tower Hamlets, Hackney, Haringey, and Barking & Dagenham, and an unemployment rate for London as a whole of around 2 percent above the national average.

Finance creates nothing. It is concerned with moving money and titles to ownership of property around. Some of that movement might be considered necessary – when it is a question of paying for wages or for goods. But the great bulk of it is concerned only with the distribution of profits between different sections of the capitalist class, as with the pass the parcel game of mortgage finance or the gambling in shares on the stock exchange. That was the great contradiction of the debt economy. Finance paid out profits to its owners, bonuses to its speculators, salaries to its workers and loans to its borrowers. But it itself did not provide any of the goods that were to be bought with these. It made nothing, but provided people with a money claim on things made by others.

The result was that it could conceal the underlying faults that were slowing the system as a whole down, but could not do away with them. Bubbles – booms paid for out of finance – were able to pull the economy out recession in the mid-1980s, the mid-1990s and the mid-2000s. Goods could be sold and that did encourage an expansion of production, sometimes as in the mid-1990s in the US by a quite large amount. But a point was always reached when the demand placed by such financial bubbles on the system as a whole could no longer be met profitably. So crises broke in 1990 and again in 2001-2. In Britain the first crisis had a devastating effect, leading to a crash in house prices, a record level of home repossessions and a number of important bankruptcies. The second crisis was less marked in the economy as a whole, which kept expanding, but it destroyed important sectors of manufacturing industry, with the collapse of two of British capitalism’s most famous firms, GEC-Ferranti and ICI.

In between these two crises to hit the Western states there was another crisis which hit 40 percent of the world. It began in Asia in 1997 in countries like Thailand and South Korea, which had been held up as example of how miraculous capitalism could be, and spread over the next year to hit Russia (which had been supposed to benefit after the collapse of its form of state capitalism in 1991) and most of Latin America. Then it came very close to hitting the US economy in September 1998, when the hedge fund Long Term Capital Management (whose directors included two winners of the Nobel Prize for economics) began to collapse. The US state, in the form of Alan Greenspan, ignored all the official neo-liberal free market ideology about people having to stand on their own two feet and called the top bankers together to a midnight meeting to order to stop the collapse, and then reduced interest rates to keep the rest of the economy from sinking. Among the corporations that stepped in to buy up a share in LTCM for $100 million was Lehman Brothers.

Greenspan’s bailout prevented the US economy going into crisis – but only for another two years.

Through 1999 and the beginning of 2000 share prices soared ever upwards. Dot com companies which owned nothing and created nothing were reckoned to be worth billions, as investment funds and rich individuals bid against each other to get a share of the action. Telecommunications companies borrowed massively to invest in huge new optic fibre cable networks. Most mainstream economists asserted that capitalism had found a “new paradigm” that meant there would never again be economic crises. Accountancy firm Price Waterhouse Coopers predicted in 1999, “The years 2000–2002 will represent the single most profound period of economic and business change that the world has ever seen, not unlike the industrial revolution but much faster – at e-speed.” Gordon Brown began a refrain that he repeated with the regularity of a cuckoo clock for the next ten years – there would be “no return to boom and bust”. The official message to people worried about getting a decent pension in their old age was to save through the funds that were gambling in the stock exchange.

Then the delusion evaporated, like every previous one. Dot com and hi tech share prices crashed late in 2000, and by the early summer of 2001 the signs of a new crisis were everywhere to be seen. The Economist magazine reported in August that year that “the sharp slowdown in America has already caused a recession, maybe not at home, but in Mexico, Singapore, Taiwan and elsewhere. In more and more countries around the world output is now stalling, if not falling. Total world output probably fell in the second quarter for the fast time in two decades. Global industrial production fell at an annual rate of 6 percent. Welcome to the first global recession of the 21st century.” The cause of the crisis was precisely the massive lending and borrowing that had created the supposed miracle of only a few months before. The Financial Times told how “a $1,000 billion (£700 billion) bonfire of wealth has brought the world to the brink of recession”.

The crisis caused the collapse of two of the giants of US industry, the energy firm Enron (whose chief, Kenneth Lay, was a signatory to the neocon Project for the New American Century) and the telecom and media giant WorldCom. The heads of both were later convicted of fraudulently exaggerating their profits. 300,000 jobs in telecoms equipment manufacturers disappeared within six months, and a further 200,000 in components suppliers and associated industries.

These reports appeared a few days before the 9/11 destruction of the World Trade Building, which has often since been blamed for the crisis. 9/11 did prompt two forms of state intervention that began to bring the crisis to an end. George Bush ordered the attacks on Afghanistan and Iraq, and introduced a massive increase in US arms spending, which was to double between 2001 and 2008, reaching a total of $700 billion. And while Bush was using arms to try to seize control of the world’s second biggest reserves of oil, Greenspan was drastically cutting the interest rate at which US banks borrowed from the Federal Reserve so as to start a new debt-based bubble. One in six US manufacturing workers lost their jobs in the recession. But there followed a renewed upsurge of borrowing, which enabled consumption in the US to rise. By the end of 2002 apologists for capitalism were boasting that “the recession has ended even before it began”. The free market was providing us with “the best of all possible worlds”, proclaimed New Labour, the Tories and the upcoming Liberal Democrat figure Nick Clegg.

What was in fact beginning was the biggest build up of debt yet – the build up that was bound eventually to come crashing down.

It was not only the US and Britain that were affected. The internationalisation of trade, investment and lending globally drew the whole world into the bubble. The US’s economic recovery was based on it spending 5 percent each year more than it produced. That was only possible because the East Asian economies, especially Japan and China, lent the US Treasury and US banks hundreds of billions of dollars each year. This money then enabled the US government to cover debts caused by its arms budget, and American consumers to buy goods that were made in China and on equipment from Japan. It also enabled major US firms like WalMart to run operations in China that boosted their profits. China was able to have very fast economic growth rates because of sales to the US – and the US was able to make those purchases because of loans from China. US industrial firms once again joined in the financial frenzy. Instead of investing most of their profits, they diverted a chunk to lending through the financial system, as a report for the IMF later told.

The whole world economy was increasingly balanced on a pyramid of debt. And a big part of the base of the pyramid was the subprime lunacy of lending to people who had been driven into poverty by job cuts and pay cuts, with little chance of ever being able to pay back all they owed.

There were a few warning voices about what was happening, even from within the ranks of the supporters of capitalism. But they were dismissed as fringe Jeremiahs. Roubini, for instance, gave a presentation to the IMF pointing to the dangers. They dismissed what he had to say because he had not presented the elaborate mathematical models beloved of mainstream academic economists. The IMF report in July 2007 was very optimistic. “The strong global expansion is continuing”, said its summary of the report. “Predictions for global growth in both 2007 and 2008 have been revised up to 5.2 percent from 4.9 percent”

For Gordon Brown – and his then boss Tony Blair – there were no doubts. Boom and bust, they continued to insist, was gone for good.

|

Yet all the time New Labour’s own policies were increasing the dependence of people on debt. “Between 2004–05 and 2006–07 incomes fell for the poorest third of households, including skilled manual workers, unskilled workers and the out-of-work poor,” according to the Institute for Fiscal Studies. Things were a little better, but not much better for the mass of white collar workers. The income of the median household grew by only 4 percent in the five years between 2001–02 and 2006–07. House prices, by contrast, were rising at a record rate, reaching a level in 2007 three times that often years before, while social housing provision was at a historic low point. Many young people without homes felt they had little choice but to borrow to the hilt to buy, while those with homes often saw remortgaging as the only way to pay essential bills.

Everything was set for a great crash, not just of finance, but for the whole system of which it was part. In July 2007 a hedge fund connected to the US investment bank Bear Stearns went bust. Then on 9 August a French bank announced it could not pay out to those who had money in two of the funds it owned. Finally on 17 August turmoil swept all the financial markets, forcing the first wave of massive intervention by central banks. Yet even then many of those who presided over the system could not admit anything fundamental was wrong. They treated it as a short-term panic that would be resolved by small cuts in a US interest rate. On 13 September Mervyn King, head of the Bank of England insisted there would be no “bailouts”. That evening Northern Rock was on the verge of going bust as people queued at its branches to try to get money out in the first bank failure in Britain for nearly 150 years. Mervyn King rushed to lend money to the bank to try to keep it afloat, while the New Labour government did its utmost to avoid nationalising it – until in January 2008 it finally saw no choice. The pattern was set for recurrent crises, not only in Britain but, more importantly, in the US, over the next year. As we have seen, 14 September 2008 would be the occasion of a much bigger crisis for the system than 14 September 2007.

FROM MUCH of the media coverage through 2007 and the first half of 2008 you might have through the crisis was simply a worry for a few top bankers and maybe a few thousand people employed by them. But it goes deeper than that.

If debt has kept the global system going, then a decline in the availability of debt is going to lead to a fall in people’s ability to buy things and to a loss of jobs elsewhere. There has already been a foretaste what that means with the collapse of the airline Zoom and the holiday firm XL, and with the rising level of job losses. Hence the predictions from mainstream economists that unemployment will rise from its current internationally measured level of 1.6 to 2 million in the next few months.

But if they were honest, they would say they do not have any clear idea what is going to happen. A year ago they were saying that growth in China and India would be able to take the place of any setback in the US; now they expect the US’s troubles to have at least some impact on China and India. Six months ago they said the crisis would hit the US, but not Europe, where the British economy was “strong” and the German economy “picking up”. Now they recognise that Europe is facing problems and the British economy is seen as the one likely to suffer most. The mainstream commentators, with only one or two exceptions, did not foresee the crash. They cannot be expected to foresee its consequences.

One of the problems for them – and for all of us who live within their system – is that the crash is only one of multiple crises affecting it. The months which saw crisis return to haunt the system also saw the return of another old spectre – inflation. For a hundred million people in the poorer parts of the world there was a sudden rise in the price of wheat, maize and rice, sometimes by 100 percent, threatening them with starvation. There were food riots in a score of countries, with strikes as well in Bangladesh, Egypt and Vietnam. The picture may not be quite as bad for most people in the old industrial countries, but the rising price of food, up 12.5 percent by August, and energy, up by another 30 to 50 percent also in August, means hardship. A survey by uSwitch suggested that households on median incomes are £40 a week worse off and that those suffering most are those in traditional working class areas. People are being forced to cut back on necessities as well as small luxuries just as the financial crash threatens more harm. For many pensioners this winter could well mean an early death from hypothermia. The food and energy crises are rooted in the same craziness that produced the debt overhang and the shift from boom to bust.

Capitalism’s slow worldwide growth through the 1980s and 1990s meant that prices fell in real terms from the very high levels of the mid-1970s and early 1980s. The big oil companies still made profits, but most held back from putting a lot of investment into looking for new oil reserves and even less into new refining capacity. Still less did they put any real investment into alternative energy sources to oil and coal, despite the already incontrovertible evidence that the carbon gases were causing potentially devastating climate change. Then came the debt-led booms of the late 1990s and early 2000s. The US economy grew rapidly just as rapid industrial growth in China began to have its impact on the world system as whole. The world began using ever increasing amounts of oil – and it did so just as US imperialism’s war on Iraq was starting. Oil that had cost $10 a barrel in the late 1990s rose to $30, then to $70 and for a time to over $100. As oil firms’ profits shot up and oil, gas and coal prices rose, financial speculators moved some of their funds from gambling on people’s homes to gambling on energy prices.

Similar factors have been behind the food price rise. Through the 1980s and 1990s the relatively slow growth of the world economy meant there was not any great pressure to encourage increased investment in producing food. Increased demand for meat from the middle classes in China and India suddenly combined with bad weather in key grain-producing places like Australia to create a world food shortage. It was made worse by the world surge in the price of oil – necessary for producing nitrogen fertilisers, running farm machinery and distributing food. Farmers in the poorer parts of the world were hit by rising costs. Making the food situation worse has been the way US and European governments have adopted a policy of using crops that could be used to feed people to instead produce biofuels so as to safeguard “energy security”, falsely claiming that biofuels cut greenhouse gases.

Now those who have overseen the creation of this multiple mess are saying that the rest of us have to pay the price for it. We cannot have wage, pension or benefit increases to compensate for soaring food and energy costs, because that will create inflation, say Brown and Darling – and there is no dissent from Cameron or Clegg. As always when a crisis breaks, they insist we are all in the boat together, hoping we won’t notice that a few privileged people stand with a whip over the rest of us who are chained to the oars. In Britain we are told that the energy companies cannot pay any of the cost of the crisis with a windfall tax, but public sector workers have to with wage increases restricted to half the official rate of inflation. As so often in the past, we are being told to tighten our belts and consume less because too much is being produced!

FACED WITH crisis in the 1930s, capitalist politicians and economists tried to solve it with bigger or smaller dollops of state capitalism. Faced with crisis in the 1970s and early 1980s they tried to solve it by the great U-turn back to the untrammelled free market. Neither method succeeded. It required war to banish the first crisis, and it required the debt mountain to achieve a partial recovery from the second. Over the last year they have turned in one direction, then another and then back again in a desperate attempt to stop the crisis deepening completely out of control. On 7 September they carried through the biggest nationalisation in world history to stop the collapse of Freddie Mac and Fannie Mae. On 14 September they insisted there was no way they were going to bail out Lehman Brothers and stop the biggest bank failure in American history. It was absolutely necessary to stop the “moral hazard” of letting financiers think the government would save them from their own folly, asserted a Financial Times editorial. On the evening of 15 September they nationalised the insurance giant AIG so as to avoid damaging the hedge funds involved in the derivatives market and so bringing down the financial system as a whole. The Financial Times editorial applauded their action. They are all like blindfolded people trying to find the key to the room they are locked in.

They have no idea what will happen next. Some predict a very serious recession, with comparisons with the 1930s. Some see similarities with what happened in Japan in the early 1990s, when a crisis led to a long spell of economic stagnation that still afflicts the country. Some think spending $700 billion or more on saving the financial system will give a further big push to inflation, forcing down the exchange rate of the dollar and possibly damaging the credit rating of the American state. Any of these scenarios is likely to mean increased turmoil in the world economy over the year ahead.

Their problem is not that they are stupid – although some of them clearly are. It is that they identify with a system whose very basis is unpredictability. It is built around blind competition between capitals – owners of the means of creating wealth – big and small. There are a couple of a thousand major multinationals, a score or so significant states and millions of small firms, all interacting in a completely unplanned manner. It is like a traffic system with thousands of cars, no traffic lights, no speed limit and not even a requirement to drive on one side of the road rather than the other that has just been hit by a bomb.

Yet two things are clear to anyone who looks critically from the outside at the system as a whole, as Marx did. First, the system is in for more chaos and more destructiveness. The US state’s expenditure on solving the crisis is producing a major increase in national indebtedness and American capitalists are not going to be happy about paying that – particularly as banks in Europe and Asia are also benefiting from the spending. They will try to pass the cost on to the country’s workers, either through inflation or recession or, most likely, both. They will also exert pressure on other states and other capitalists to pay for their mistakes. The Project for the New American Century that led to the wars in Afghanistan and Iraq was about American capitalism lording it over the rest of the world, and the US state was looking for ways to reverse the setbacks it had suffered in occupying those countries before the financial crisis broke – that was why it encouraged Israel to attack Lebanon two years ago, Ethiopia to attack Somalia last year, and Georgia to attack South Ossetia on Russia’s borders in early August. It will be even keener to assert itself now that the cost of paying for that crisis has landed on its shoulders, with the German finance minister Steinbrück saying this spells the end of the US’s role as a “financial superpower”. It will also be even more loath than it has been so far to make the expenditures necessary to ward off climate change.

Second, there is no answer to this chaos through half-baked measures like greater regulation or calling for more money to be pumped into the financial system. There has been a fascinating debate in the Financial Times between two arch-supporters of capitalism, Martin Wolf and John Kay. Wolf argues that only more regulation can save capitalism from itself. Kay replies that the bankers, with the huge wealth still at their disposal, will always be able to hire the cleverest people and use the most expensive technology in order to find a way round every regulation. It should be added that they will also do what they have always done once their immediate troubles are out the way. They will threaten to move wealth abroad or to sabotage national economies through “investment strikes” if governments take regulation too seriously.

The system needs regulating but cannot be regulated. That is its problem. Our problem is that this system, either way, cannot serve the interests of the mass of people. Some at least of those who lost their jobs at the Lehman Brothers office in Canary Wharf on 15 September must, in however a confused way, have felt that – and many more will have done so among the 75,000 holiday makers banned from taking their planes this summer or above all among the 180,000 Americans who saw their homes repossessed in July.

The crisis is a result of the fact that the system is based upon a great contradiction. There is massive dependence o people on each other across the world through the global system of production, for the goods needed to maintain our livelihoods, yet control lies in the hands of rival privileged groups who compete to exploit the rest of us. There is only one answer to that: to struggle to take control of the means of creating wealth into the hands of the mass of people so that cooperation to produce the things we need replaces competition for profit. Only then can consumption and investment be kept in line with each other so as to stop crises of overproduction. Only then will we end the absurdity of poverty in the midst of plenty, of people having to consume less because too much is produced. Only then can we put democratic planning in the place of frenzied gambling with people’s houses, jobs and debts. To finally get rid of capitalist crises, in short, you have to get rid of capitalism.

That, of course, is easier said than done. The most powerful people in the world, armed with the most powerful weapons, financial, economic, ideological and military, will resist change. But understanding that is what needs to be done is an important first step. And there are simple arguments that can be put forward. The answer to the banking crisis is not regulation, or nationalisation of one or two banks, but a takeover of the whole banking system. And the nationalisation should be to stop repossessions and to stop debt strangling the world’s poor, not to rescue the stratospheric salaries, savings and pensions of the bankers. In the same way, the answer to the world’s energy crisis – and to the terrible, seemingly unstoppable, advance of climate change – is nationalisation of the oil, gas and coal industries so as to provide people with the heat and light they need now and reduce drastically the amount of energy needed to provide it.

These arguments all make one simple point. George Bush has enacted (with Gordon Brown’s support) what Roubini describes as “a massive act of privatisation of profits and socialisation of losses”, “socialism and corporate welfare for the rich, well connected and Wall Street”. What the mass of people whose labour has kept society going need is socialism for the workers, the poor and the future of humanity.

But there also immediate things to be done to protect people against the triple crises of recession, food prices and fuel poverty. Supporters of the existing system believe they can survive any crisis, however much it hurts millions of people, through a mixture of lies, minuscule bribes and threats. The lies will be that someone other than capitalism is responsible for the loss of jobs or the shortage of homes – the worker in a Chinese sweatshop, the Polish plumber, the refugees who have fled from a war instigated by the US on the far side of the planet. The minuscule bribes will take the form of slightly enhanced redundancy pay, or slightly reduced cuts in real wages and pension entitlement; the threats will take the form of talk of moving jobs overseas or withdrawing benefits for the unemployed. By resorting to these methods the smart suits of Westminster and Washington, as well as Wall Street and the City of London, hope a massive sense of popular anger can be deflected until the grim reality of unemployment, a torrent of repossessions and of having to make do in the face of rising prices and unpayable energy bills demoralises people. Against this our most important weapons are to seize every opportunity to put up resistance and to counter division with solidarity.

Individually people are powerless in the face of such a crisis. But the anger produced as the crisis hits the mass of people can create the upsurges of protest that our rulers cannot completely ignore – and which also show how much can be achieved if we fight back together. In the United States the two political parties and virtually all the senators and congressmen are in the pockets of the giant banks and corporations. Yet the wave of anger from below has forced them at least to pretend to worry about what happens to those facing eviction or unemployment. How much more can be achieved if the anger is directed so as to unite different struggles around the common theme that working people should not pay for the capitalists’ crisis.

Many thousands of people have already signed a People before Profit Charter which contains a few simple defensive demands around which everyone should unite. If we do, we can ensure that we do not pay the price of their biggest crisis for decades.

Inflation and recession are now tightening their grip on the economy with every day that passes. Working people face rapidly increasing prices, especially for food and fuel; government led pay restraint; rising unemployment and a disastrous housing crisis. At the same time the super-rich continue to enjoy huge profits, salaries and bonuses – yet pay less tax than under the Tories. The desperation felt by many is having equally serious political effects: the resurgence of the Tories and an increase in anti-immigrant and fascist arguments. We need a coordinated response to these threats. As part of this response please add your name to this Charter and then move support for the Charter at your trade union, party or campaign organisation.

Many workers and trade unionists are now engaged in strikes and protests to defend their pay, jobs and services. We pledge ourselves to support their action and to support the campaigns that are dedicated to protecting working people, including: Unite Against Fascism, Public Services not Private Profit, Defend Council Housing, Stop the War Coalition, Keep Our NHS Public.

Last updated on 3 May 2014