From Socialist Review, No.152, April 1992, pp.10-13.

Transcribed & marked up by Einde O’Callaghan for the Marxists’ Internet Archive.

|

The world recession is turning into slump. It produces human misery for most workers, and strikes fear into the hearts of the capitalist class. And, says Chris Harman, they see no easy way out of the crisis |

Some assessments say this is the deepest crisis since the 1930s. Others say it is much less severe. Who is right?

|

The latest figures show total output has now fallen by the same amount as in 1980-81. But more important than the total fall is the fact that it has affected the service sector, which continued to grow last time round, as well as manufacturing, and that there seems very little chance of recovery in the near future. After the hype of 1987-88 about how market capitalism worked so wonderfully, we are now in the third international economic crisis in just over a decade and a half.

And it is even more obvious with this recession than with the previous two that it arises out of features internal to Western capitalism. They can’t try to blame it, as they did the recessions of 1974 and 1980-81, on rising oil prices. Instead they have to blame lunacies’ associated with the period of ‘economic recovery’ that preceded it.

This is causing deep pessimism among those who were most enthusiastic about the Thatcher and Reagan ‘miracles’. It is usually ‘monetarist’ economists who see the present recession inevitably deepening into a slump like that of the early 1930s.

For the moment, the recession in Britain is still not quite as deep when it comes to production industries as it was 10 years ago. But capitalists are assessing the situation every day, to see whether they need to cut back their operations still, more to cope with declining markets – and each cut back results in a diminished market for other capitalists. The worst fears of the ruling class pessimists is that major firms will start pulling one another down into bankruptcy, creating black holes at the centre of the system.

The scale of the losses of a company like General Motors shows how precarious some of the capitalist giants are.

But the system has not reached that point yet. It is worth remembering that a world crisis as bad as that of the early 1930s would involve levels of unemployment in the major Western economies three times as high as at present.

What is the role of financial capital and debt in this crisis?

One distinctive feature of the present recession compared with that of the early 1980s, which could lead to it deepening much more, is the weakness of the banks. They lent out huge sums to both companies and individuals – and in the US to the state itself to finance its arms spending and budget deficit – during the Reagan and Thatcher booms. And the first government attempts to keep the boom in the financial sector in check were quickly reversed when they led to the stock market crash of October 1987. Both American and British governments encouraged more borrowing to keep the boom going a couple more years than it would have otherwise.

In Japan and West Germany, borrowing did not outstrip saving on the same scale as in the Anglo-Saxon economies. But Japanese banks did embark on an orgy of investment in speculative real estate companies, forcing up stock exchange prices far beyond the real value of Japanese industry and then using the apparent increased worth of shares in their possession to justify further lendings. And in the brief euphoria about business opportunities in the east which followed German reunification, the German government turned its back on its old financial rectitude and created a sharp rise in the demand for west German goods by pouring vast sums into east German markets.

All this lending was justified at the time by claims that it would lead to a growth of the real economy – of increased output of goods – and that this would allow companies and individuals to repay their debts easily. But the growth of debt was far more rapid than the growth of output – in Britain, for instance, the ratio of personal debt to disposable income was twice as high in 1990 as it had been ten years before.

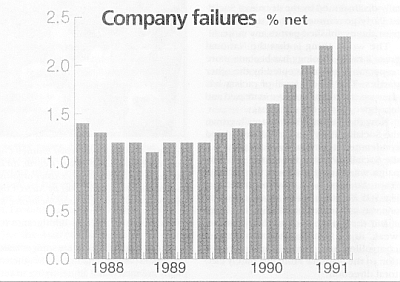

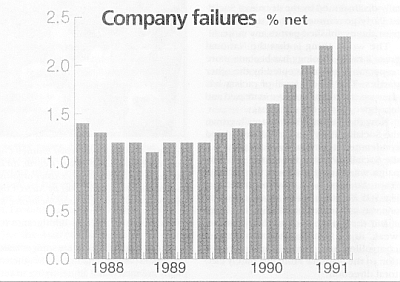

Eventually, governments panicked about the inflationary consequences of allowing lending to grow so rapidly. They took the first steps to clamp down on it in the US and Britain in 1989 and in Japan and Germany last year. The result was a surge in interest rates that suddenly made it very difficult for many firms and individuals to keep ahead of their debtors. Firms began to go bust and not just small firms, but giants like the Maxwell firms and Pan Am – and the employees they had sacked could no longer pay their mortgages. The banks could not get back a lot of the money they had lent and were left, at most, in possession of speculative office buildings, decaying factory accommodation and houses whose sale prices were falling by the day.

The worst fear of the ruling class pessimists is that big banks themselves begin to go bust, so wiping out the funds lent to them by profitable industrial concerns and the savings of millions of individuals. It was when this happened in 1930-31 that the crisis that began in 1929 got completely out of control. The sudden collapse of BCCI last summer shows that it is not an eventuality that can be completely ruled out this time round.

As it is, the banks are trying to avoid further losses by restricting their lending, especially to firms that might be in trouble. And firms are trying to restrict their borrowing, in case the burden of repayment pushes them over the brink. And so, every time a firm loses markets as a result of its customers being hit by the recession, it cuts back on its own consumption and the number of workers it employs – destroying markets for other firms in the process.

When we talk about the importance of debt, does this mean we are abandoning the traditional Marxist view of the cause of the crisis – the tendency of the rate of profit to fall?

Not at all. The debt burden is one of the ways in which a falling profit rate through the capitalist system as a whole finds expression.

In a boom, profit rates begin to come under pressure as capitalists, in their desire to outcompete each other, expand their investment in plant and machinery much more rapidly than in the labour force.

This happened through the mid-1980s in all the major Western countries – indeed, in the US and Britain, the rise in investment was actually accompanied by a continuing decline in manufacturing employment. Since labour is the source of value, and therefore ultimately of profits, the ratio of profits to investment – the rate of profit – began to come under pressure.

But the pressure on profit rates does not automatically have to translate itself into an immediate fall in the profits of individual companies.

First, they provided themselves with partial protection against this by increasing the share of value that went to profits as opposed to wages. This was most obvious in the US where ‘concessions’ – workers accepting cuts in wages and health care benefits – took place. In western Europe and Japan the real wages of employed workers rose slowly, but not nearly as fast as productivity, so allowing the bosses to pocket more of the value produced by each worker.

However, there were limits to the ability to increase profits in this way. As Marx pointed out in Capital, it is not possible to raise profits indefinitely, simply by increasing the exploitation of a smaller number of workers: even if a capitalist were able to take all the value produced by 50 workers, he would not be able to make as much profit as taking only two thirds of the value produced by 100 workers.

What is more, in any boom a point is reached where firms begin to compete with each other for real labour, bidding up wages and giving workers increased confidence to fight on their own behalf. Individual firms then try to protect their profits by pushing up prices, creating inflationary pressures throughout the system. This is precisely what began to happen in Britain in 1987-88.

It is at this point that pressure begins to build up in the banking system. Individual banks are only too happy to lend money to firms whose future profits seem assured by growing markets and rising prices. They also lend to individual consumers who seem to be guaranteed rising salaries and wages.

But in order to lend, the banks have to borrow. Most of their borrowing is from firms who have made profits but do not want, yet, to invest them. If the rate of profit is high, there is no problem. The banks are stashed full of money and are ready to lend it for low rates of interest. But once the rate of profit begins to fall, the demand for bank funds suddenly exceeds the supply and interest rates begin to soar.

A high rate of interest is, in other words, a sign that the rate of profit throughout the system is under pressure. It usually signals the point at which a boom begins to turn into a slump.

Even when a boom has passed its height, financial chicanery can create the impression that individual firms are continuing to make profits – for instance, by counting the speculative rise in the value of things like real estate holdings as profits. This was true with firms like Coloroll, Polly Peck and Maxwell Media Communications right up to the moment they began to crash. It is often only the trend of interest rates which shows the real weakness of the system.

However, once interest rates do soar, they expose the real condition of profit making in industry.

This became clear in Britain after 1987. The Bank of England Quarterly tells that the pre-tax rate of return on capital of non North Sea oil firms fell from 11 percent in 1988 to just over 6 percent in 1989-90. Figures for major firms this year indicate a further considerable fall.

Meanwhile the average borrowing by firms rose 4.4 percent in 1987, 20.4 percent in 1988, 33.9 percent in 1989 and 20.3 percent in 1990 – by which time it was more than twice the 1987 level.

Firms were forced to cut their costs to the bone to pay the banks for past loans, and banks were then forced to cut back on new loans to balance their books. The cumulative effect was to push the whole economy downwards.

But that in turn increased the pressure on the banking system as firms, which were really losing money on everything they made and sold, tried to keep afloat by further borrowing.

Finally, the takeover boom of the late 1980s exerted further pressure on individual firms. Company directors tried to stave off hostile bids by stepping up dividends and forcing their share prices up: dividends rose 20.4 percent in 1988, 33.9 percent in 1989 and 20.3 percent in 1990. This benefit to the share owning section of the capitalist class had the effect of denuding the firms themselves of cash just when they needed it to pay off rising interest payments out of declining profits. A ‘crisis of liquidity’ followed in which many firms found they simply could not meet their bills.

What is the relationship between the British and the world crisis?

The aim of the Thatcherites was to reverse the long term decline of British capitalism. They really believed that simply letting the market rip with deregulation, the abandonment of exchange controls, privatisation, the Big Bang, income tax reductions and so on would do this. When the boom got out of control around the time of the last election, they really thought they had achieved their economic miracle.

The Economist boasted at the time, for instance, of ‘the ending of decades of relative economic decline’, insisted ‘the sliding has stopped’ and claimed ‘the British economy grew faster than America’s in 1985 and 1986, and than Japan’s in 1986, and will probably do so again this year.’

The last two years have shown how stupid all that talk was. The relative decline of the British economy continued through the 1980s, with a fall in productive investment concealed by the mid 1980s rise in speculative investment on the banking system itself, the City of London and things like Canary Wharf. It was only in 1988 and 1989 that manufacturing investment began to rise, only to be knocked down again by the recession in 1990 and 1991.

One result is that today, in the middle of the recession, there is the sort of excess of imports over exports that British capitalism used to suffer only in booms:

Another result is that the pressure on borrowing is so great that firms don’t want to invest, while most middle class and working class people cannot afford to spend on consumer durables or new housing.

There has been an argument between the Labour and Tory front benches over what caused the British crisis – the government or the world recession. The reality is that because the British government was in the vanguard of letting the market rip in the 1980s, the recession hit Britain before and more deeply than in other advanced countries, apart from the US. But the recession is now affecting all the other major countries, with the result that a change in British government policy alone does not point to any way out of it. A Labour government will be as much a prisoner of forces beyond its control as the Tories have been.

Many economic commentators have talked about capital investment by the state as providing a way out. In Australia the government has embarked on increased state spending to galvanise the economy. Are we seeing a return to Keynesian solutions and will they work?

The Tory government began following a version of Keynesianism last year.

Keynes preached that the answer to a recession was for the government to spend more than it collected in taxes. This would create demand in the economy for various kinds of goods, so stimulating firms to produce and invest. The resulting increase in output would eventually enable the government to get increased tax revenues and pay off its borrowing.

When Major and Lamont said that government revenues had to equal government spending ‘over the economic cycle as a whole’ they were accepting Keynesian ‘pump priming’ to get out of the recession – something which Thatcher used to reject outright.

The disagreement between Labour and the Tories has not been over whether there should be such Keynesian measures – or even about how expensive they should be (since both accept that the ERM limits how much borrowing they can make). The difference has been over whether the pump priming should take the form of increasing the incomes of consumers – and mainly better off consumers – through tax cuts, or by limited, direct government investment in the infrastructure and training.

Neither sort of Keynesianism can, however, offer more than short term relief.

They can provide a limited market for goods, and so enable firms to sell things at a profit in a way that would not otherwise be possible. But they cannot stop longer term pressures on the rate of profit. And the government borrowing which finances them implies further pressure on interest levels throughout the economy. What is more, the last 20 years have seen an incredible internationalisation of production, so that increasing demand means increasing the demand for imports as well as for home produced goods, putting further pressure on the balance of payments.

In Britain’s case that could very quickly translate into pressure against the value of the pound inside the ERM.

Keynes developed his theory in the inter war years, when the world was much more segmented into national economies than today. And implementation was always, in practice, associated with three things – increased state control over the behaviour of individual companies, increased state organisation of trade and increased military expenditures. It was this combination that allowed first Japan, then Nazi Germany, Britain and finally the US to escape from the slump of the 1930s.

Keynes may have been a liberal, but it was militaristic state capitalism which in practice followed a programme that corresponded to his schemes.

The world is much more integrated economically than it was in Keynes’ time, and this makes the implementation of such schemes much more difficult. It was, after all, the failure of mildly Keynesian measures to ward off the recession of 1974-76 that led to most pro-capitalist economists abandoning Keynesianism for monetarism. Labour Prime Minister James Callaghan gave expression to this shift in the orthodoxy when he told the 1977 party conference, ‘I used to believe governments could spend their way out of recessions. Now we know this is not true.’ What we are witnessing now is the collapse of monetarist orthodoxy and a limited swing back to Keynesianism. But it cannot be any more successful than it was 16 years ago.

One of the characteristics of the present crisis is that supporters of the capitalist system do not see an easy way out of it. They can suggest palliatives which might bring about a limited economic revival in six months or a year’s time. But they cannot see how to turn that revival into a fully fledged boom, or how to stop the debt overhang strangling it very quickly.

We are seeing some intense attacks on workers through job losses. Are these redundancies enough to get British capitalism out of the crisis?

There are two sorts of jobs cuts taking place. For instance, some in the motor industry are part of long term plans by firms to restructure their operations and to increase productivity. These enable them further to increase the exploitation of the workforce and, they hope, to ease the pressure on their profits.

Other sackings, however, are acts of desperation by firms who see no way to survive but to withdraw from whole areas of production – even from areas they expect to become profitable if and when economic revival takes place. Such sackings save them in the short term, but weaken them in the long term.

For British capitalism that is very serious. It will emerge from the recession with a weaker domestic industrial base than when it entered, leaving it worse placed to compete against American, European and Japanese industry.

The recession of the early 1980s was supposed to make British manufacturing firms ‘leaner and fitter’. Some capitalists certainly did gain in this way – but only by leaving their total industrial base too small to prevent their balance of trade going into deficit in the boom, and, for the first time ever, staying in deficit in the present recession. This time round, they can be left with an even worse hangover.

So is there nothing capitalist governments can do?

There are always some measures capitalist governments can take. They can, for instance, exert more downward pressure on workers’ living standards, on welfare services and so on. But such measures can only ease some of the symptoms of crisis for the capitalist class, they do not get rid of the underlying problems.

To even begin to deal with these, they would need to follow much more drastic measures – measures which would be painful not merely to workers but to important sections of capital as well.

Two extreme measures are available to them. The first would involve allowing inflation to rip, so as to wipe out the value of the debt overhang on industrial firms. But this would produce howls of outrage from those capitalists who have done the lending and would fuel fights by workers to keep ahead of the rate of inflation. It is difficult to see either a Tory or a Labour government adopting such a policy in the short run.

The other measure would be to allow the crisis to deepen deliberately, in the hope that the bankruptcy of a series of major firms would leave leeway for other firms to return to high profits at their expense and to begin to expand out of the recession.

This was the classic 19th century way of escaping from recession, the way that was so beloved of the Thatcherites. But it is a very difficult option for modern capitalism, with its huge interlocking forms, to follow. When these giants go bust, instead of allowing their rivals to grow, they can pull them down too, leading to an even greater scale of economic devastation.

It is therefore an option which, if followed through to the end, could lead to immense divisions inside the ruling class and bitter struggles between the classes. Again, it is not an option we can expect in the short term.

Will the attacks on workers produce a fightback?

We have to distinguish between the immediate economic struggle of workers – which is usually dampened down by a recession like the present one – and the level of instability of the system as a whole.

A crisis is a period in which the expectations of whole layers of society are suddenly shattered, in which they suddenly find it difficult to live in the old way. This does not automatically lead to mass struggle. It can lead to longer or shorter periods of confusion, in which people simply don’t know how to come to terms with what is happening to them. The result can be enormous political volatility.

The political instability is increased by the uncertainty and divisions within the ruling class, who will veer between trying to create a popular base for themselves to stabilise the situation and seeing the need to embark on confrontation in order to restore profit levels.

In such a situation, periods of political calm give way to sudden explosions and sudden explosions die away leading back to periods of deceptive calm.

We have seen what this means in the last two years – the anger around the poll tax and the rows over Europe within the ruling class, the two months of calm before the sudden reality of the Gulf War, the crowing of Bush about victory giving way to the sudden unpopularity of his domestic policies and the upsetting of the Tories’ electoral timetable by the deepening of the recession.

The difficulty for socialists in such a period is that for months at a time we seem on the margins of effective politics, talking to small groups of people about the activity of a class which is not confident enough to fight. And then suddenly fights erupt – often provoked by the ruling class or right wing political forces – which we have to play a part in.

We can only prepare for sudden explosions of struggle if we know how to pull people around us politically during the periods of calm which go before.

Last updated on 18 June 2010